Portfolio construction is often presented as a secondary concern to security selection. In practice, the opposite is true. For long-term investors, outcomes are driven far more by asset allocation and structure than by individual investment decisions. This report outlines a foundational portfolio framework commonly used by professional allocators and financial institutions when designing durable, long-term portfolios for broad audiences. The objective is not to optimize for short-term performance, but to construct a system capable of compounding through multiple market cycles. By examining the role of each asset class, the logic behind diversification, and an illustrative model portfolio built with widely used instruments, this paper provides a clear and replicable blueprint for understanding how portfolios are structured in practice.

I. Why Portfolio Structure Matters More Than Picks

Long-term investing is less about forecasting outcomes and more about managing uncertainty. Markets are inherently unpredictable over short horizons, but highly consistent over long ones. Portfolio structure exists to bridge that gap. Rather than attempting to anticipate which asset will outperform next, professional investors focus on building portfolios that can endure a wide range of economic environments.

This is why asset allocation has historically explained the majority of long-term portfolio results. A well-constructed portfolio is designed to capture growth when conditions are favorable, preserve capital when conditions deteriorate, and maintain discipline throughout both phases. The purpose of structure is not to eliminate volatility, but to make it survivable.

Home insurance rates up by 76% in some states

Over the last 6 years, home insurance rates have increased by up to 76% in some states. Between inflation, costlier repairs, and extreme weather, premiums are climbing fast – but that doesn’t mean you have to overpay. Many homeowners are saving hundreds a year by switching providers. Check out Money’s home insurance tool to compare companies and see if you can save.

II. The Role of Diversification

Diversification is often misunderstood as simply “owning many things.” In practice, diversification is about combining assets that behave differently under stress. Assets that respond differently to inflation, recession, interest rate changes, or geopolitical shocks reduce the likelihood that any single event permanently impairs the portfolio.

A diversified portfolio does not maximize returns in every environment. Instead, it minimizes the risk of catastrophic outcomes while allowing compounding to do its work over time. This tradeoff is foundational to institutional portfolio design and is especially important for long-term investors who cannot afford to exit markets at the wrong time.

III. Core Asset Classes and Their Functions

Professional portfolios are typically constructed around a small number of core asset classes, each serving a distinct function.

Equities exist to drive long-term growth. Bonds exist to provide stability and income, particularly during equity drawdowns. Real assets such as gold exist to hedge against inflation and systemic stress. Alternative assets, including limited exposure to digital assets, may provide diversification benefits but are treated as non-core due to higher volatility.

The effectiveness of a portfolio depends not on maximizing exposure to any single asset, but on balancing these functions in a way that aligns with long-term objectives.

IV. An Illustrative Long-Term Portfolio Framework

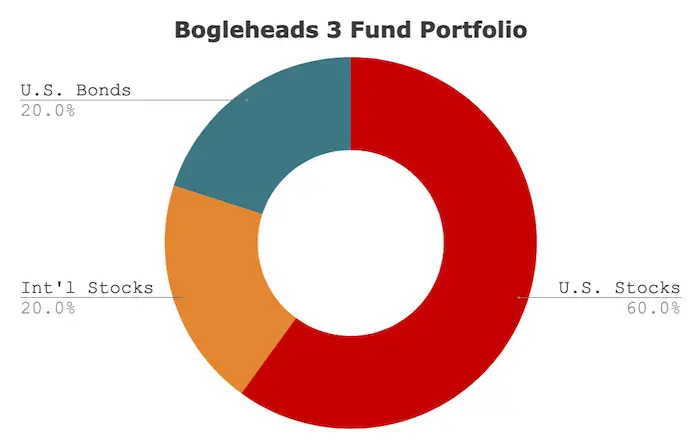

The following model portfolio reflects a structure commonly referenced by large asset managers, academic research, and long-standing professional practice. It is presented for educational purposes to demonstrate how portfolios are often constructed, not as a recommendation.

U.S. Equities — 55%

Vanguard Total Stock Market ETF (VTI)

This allocation represents the core growth engine of the portfolio. VTI provides exposure to the entire U.S. equity market, including large-, mid-, and small-capitalization companies. Broad U.S. equity exposure has historically been the primary driver of long-term returns, and using a single, low-cost index fund simplifies implementation while maintaining diversification.

The emphasis on U.S. equities reflects both market depth and liquidity, as well as the role of U.S. companies in global economic growth.

International Equities — 15%

Vanguard Total International Stock ETF (VXUS)

International equities provide diversification beyond the U.S. market. This allocation captures developed and emerging market exposure, helping reduce reliance on a single economic region and mitigating currency and valuation risk.

A modest international allocation reflects professional consensus that global diversification improves long-term risk-adjusted outcomes, even if U.S. equities dominate returns in certain periods.

Fixed Income — 20%

Vanguard Total Bond Market ETF (BND)

Bonds serve as the portfolio’s stabilizing force. BND provides broad exposure to U.S. investment-grade bonds, including Treasuries and corporate debt. During equity market stress, bonds have historically acted as a shock absorber, reducing volatility and providing liquidity.

In higher interest-rate environments, bonds also contribute income, reinforcing their role as a defensive component rather than a growth asset.

Gold — 5%

SPDR Gold Shares ETF (GLD)

Gold is included as a hedge against inflation and systemic risk. Unlike financial assets, gold does not rely on earnings, interest payments, or creditworthiness. Its value has historically held up during periods of market stress, currency debasement, and geopolitical uncertainty.

A small allocation to gold has been shown to reduce overall portfolio volatility without materially sacrificing long-term returns.

Digital Assets — 5%

iShares Bitcoin Trust (IBIT) or Similar

Digital assets are treated as a speculative diversifier rather than a core holding. Bitcoin exposure introduces significant volatility and should be sized accordingly. Most professional frameworks suggest minimal allocations, if any, due to uncertainty around long-term behavior.

A limited allocation reflects growing institutional interest in digital assets as a potential diversifier, while acknowledging their risk profile and non-essential role in portfolio stability.

V. Putting the Structure Together

Combined, this illustrative portfolio allocates approximately 70% to equities, 20% to bonds, and 10% to alternative diversifiers. The structure emphasizes growth while maintaining meaningful risk controls.

Importantly, the simplicity of this framework is intentional. Professional portfolios often favor fewer components that are clearly understood over complexity that increases behavioral risk.

VI. Rebalancing and Discipline

Portfolio construction does not end once allocations are set. Over time, asset values drift as markets move. Rebalancing restores the intended structure by trimming outperforming assets and reinforcing underweighted ones.

This process enforces discipline and prevents portfolios from becoming unintentionally concentrated. Periodic rebalancing, typically on an annual basis, is a standard institutional practice and a critical component of long-term success.

Successful investing is not about constant action. It is about building a system that can endure uncertainty, volatility, and time. The portfolio framework outlined here reflects how professionals approach that challenge: by focusing on structure, diversification, and discipline rather than prediction.

For long-term investors, clarity is an advantage. A portfolio that is simple, diversified, and well understood is far more likely to be maintained through difficult periods than one built on complexity or conviction alone. Over decades, that discipline, not brilliance, determines outcomes.

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

—

Education, not investment advice.

Sources: