Your Friday Market Brief

Opening Insight

This was one of those strange in-between weeks where time slows down but markets don’t. Christmas cut the trading week in half, liquidity vanished quickly, and price moves became exaggerated. With desks lightly staffed and books being closed, investors weren’t reacting to fresh headlines — they were settling accounts from a long year. The Fed’s December minutes landed into that environment and reinforced caution, not excitement. Tech cooled after a dominant run, energy quietly pushed back into focus, crypto stayed selective, and commodities showed how quickly positioning can unwind when volume disappears.

Market Recap

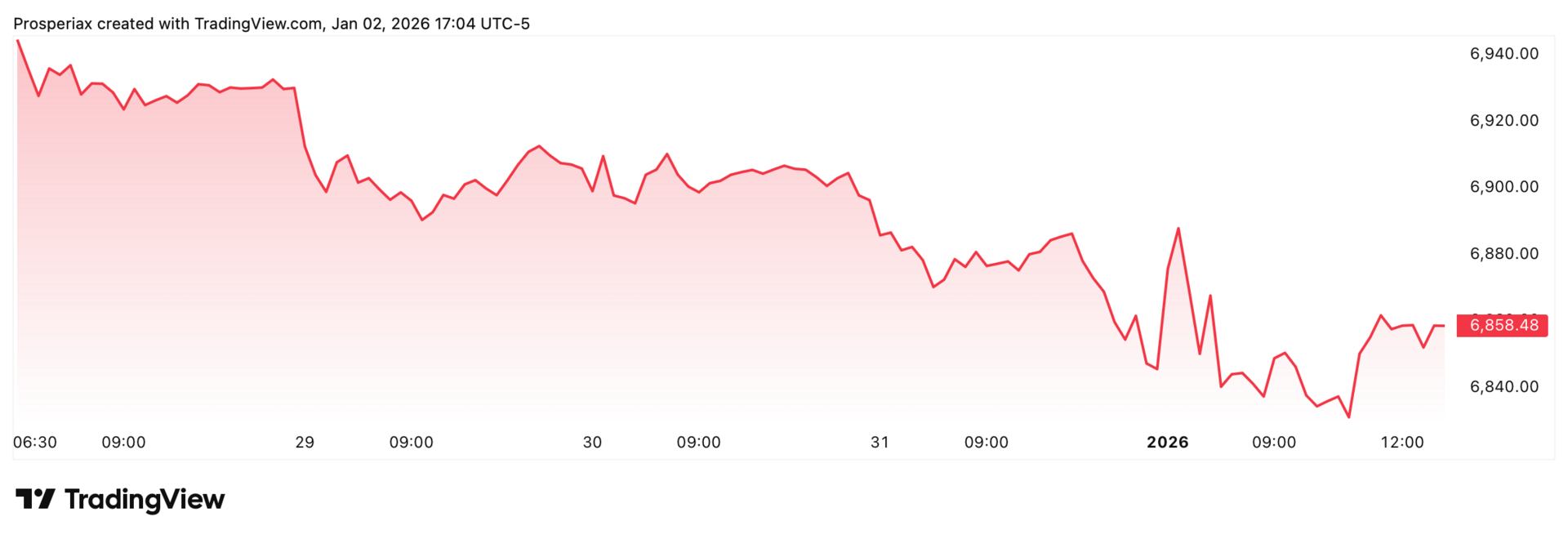

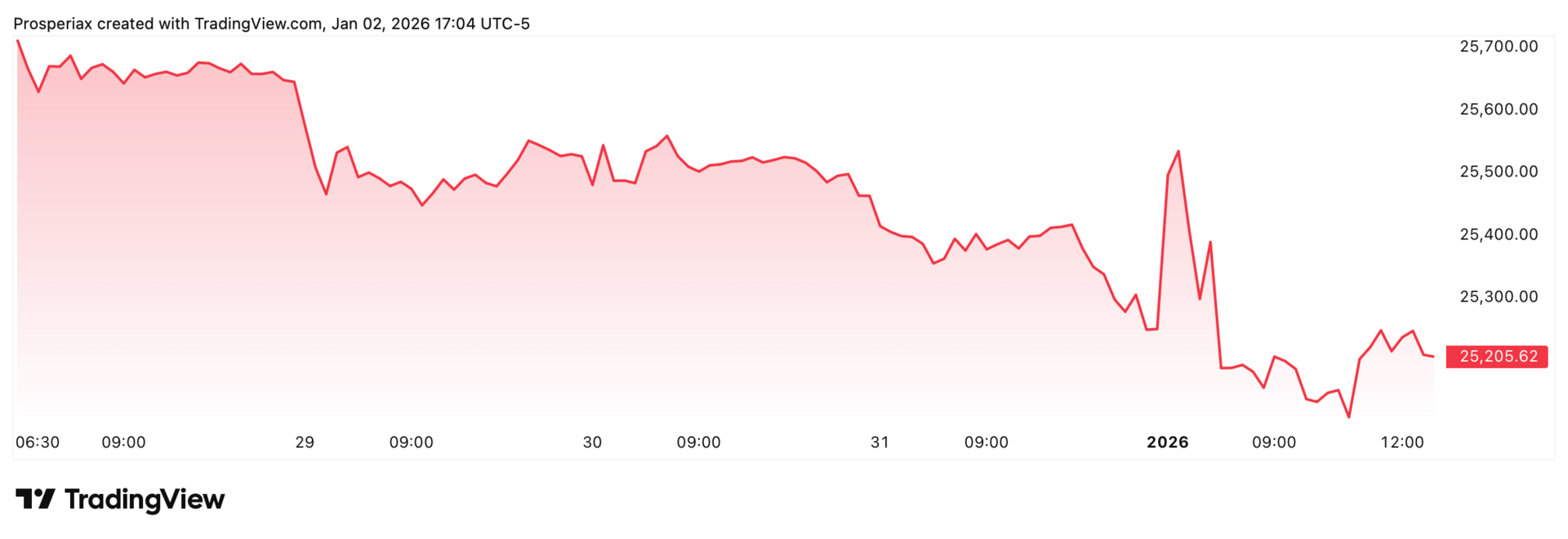

U.S. equities ended the week modestly lower in choppy, low-volume trading. The S&P 500 slipped roughly one percent, while the Nasdaq underperformed amid continued pressure on large-cap technology. The Dow Jones was comparatively stable, oscillating between small gains and losses. Volatility lifted from recent lows but remained contained, reflecting repositioning rather than stress. Despite the late softness, indexes finished the year near highs after a strong annual run, suggesting consolidation rather than a shift in broader market conditions.

The S&P 500 declined roughly one to one and a half percent. Technology weighed most on the index, while Energy provided a meaningful offset. Defensive sectors were relatively stable, limiting the depth of the pullback.

The Nasdaq fell modestly as high-growth software and mega-cap technology faced profit-taking. Semiconductor strength helped cushion losses, but rising yields and valuation sensitivity kept pressure on rate-dependent names.

Stocks That Won The Week

MICRON

$MU

+12.82%

Shares surged after strong earnings and guidance reinforced expectations for sustained AI-driven memory demand and tight supply conditions.

SANDISK

$SNDK

+14.47%

Momentum continued as investors extrapolated strength across memory markets following Micron’s results, extending an already strong year.

BLOOM ENERGY

$BE

+13.53%

The stock rallied on improved forward outlooks tied to rising demand for reliable on-site power solutions supporting data centers.

Stocks That Lost The Week

APPLOVIN

$APP

−12.30%

Ongoing regulatory scrutiny, insider selling, and valuation compression drove continued unwinding after a strong prior run.

MGM CHINA

$MCHVY

−18.26%

Shares fell sharply after higher royalty costs pressured margin outlooks and prompted downward earnings revisions.

COGENT BIOSCIENCES

$COGT

−9.25%

The decline followed clustered insider sales, triggering profit-taking after outsized gains earlier in the year.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology - $XLK | −1.57% | −0.91% |

Energy - $XLE | +3.00% | +2.08% |

Financials - $XLF | −1.40% | +0.18% |

Industrials - $XLI | 0.39% | 1.52% |

Healthcare - $XLV | -0.11% | 0.41% |

Energy led the week as capital rotated toward cash-generative value exposures. Technology lagged under valuation pressure, while Financials softened alongside a flatter yield curve. Industrials were modestly higher, supported by defense and aerospace strength. Healthcare remained broadly stable, with defensive pharma gains offset by insurer weakness.

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

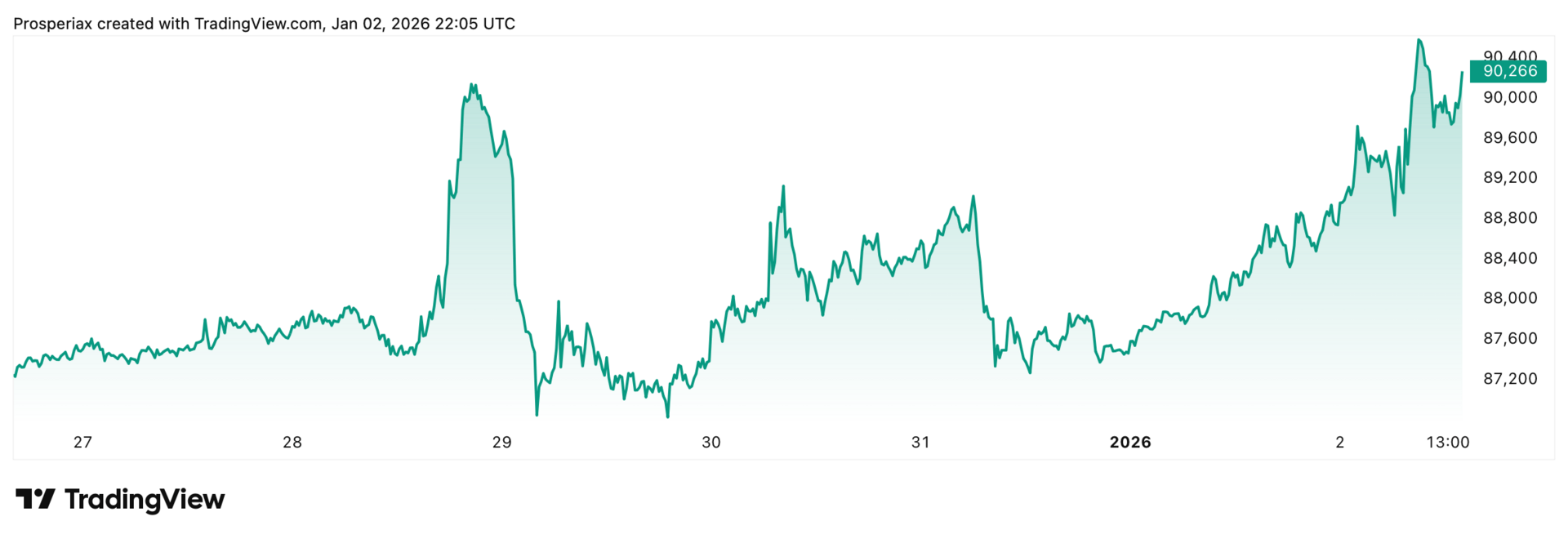

Crypto Recap

Crypto markets traded quietly in holiday conditions. Bitcoin and Ethereum remained range-bound with muted volumes. Solana outperformed, lifting overall market performance slightly, while XRP held recent gains despite volatility. Liquidations were limited, and sentiment remained neutral, reflecting consolidation rather than distribution.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin ($BTC) | +2.90% | +2.46% |

Ethereum ($ETH) | +7.38% | +4.98% |

Solana ($SOL) | +5.77% | +5.41% |

XRP ($XRP) | +8.16% | +7.71% |

Mover Of The Week

XRP

XRP was the week’s largest mover as renewed institutional interest and regulatory clarity expectations drove volatility. Optimism around broader adoption, coupled with speculative positioning into year-end, pushed price action higher despite otherwise muted activity across major crypto assets.

Commodities Recap

Commodities experienced sharp internal rotations. Gold pulled back after a historic rally, while silver saw extreme volatility but finished near flat. Oil drifted lower amid oversupply concerns despite supportive geopolitics. Copper advanced on optimism tied to industrial demand and supply constraints.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold - $XAUUSD | −3.84% | +0.08% | Record rally meets year-end profit-taking |

Oil - $CL1! | −1.46% | −0.21% | Oversupply and soft seasonal demand |

Copper - $HG1! | +1.89% | +0.02% | Industrial optimism supports prices |

Silver - $XAGUSD | -0.11% | +1.23% | Margin hikes trigger volatility |

Macro Drivers

Late-year positioning and monetary expectations drove commodity moves, with silver acting as the stress point. Heavy leverage and crowded paper positioning in precious metals were exposed as margin requirements rose, forcing rapid deleveraging. That dynamic spilled into gold, amplifying downside despite unchanged long-term fundamentals. Energy markets continued to balance OPEC support against mild winter demand and elevated inventories, while industrial metals held firmer on expectations of future stimulus and structural electrification demand. A slightly stronger dollar added headwinds, but across commodities, price action was ultimately shaped more by liquidity, leverage, and positioning than by shifts in underlying fundamentals.

AI in CX that grows loyalty and profitability

Efficiency in CX has often come at the cost of experience. Gladly AI breaks that trade-off. With $510M in verified savings and measurable loyalty gains, explore our Media Kit to see the awards, research, and data behind Gladly’s customer-centric approach.

Final Take

By the end of the week, the tone was clear. Trading slowed, conviction faded, and most of the movement came from positioning rather than fresh ideas. Energy quietly stepped back into the conversation, technology cooled after carrying the year, and crypto stayed surprisingly measured given the broader volatility. Commodities, especially silver, were the reminder that thin liquidity and leverage can turn routine adjustments into violent moves faster than most expect.

Looking ahead, January will bring clarity. Incoming labor data, early earnings signals, and evolving rate expectations will shape whether markets resume risk-taking or extend consolidation. The absence of a late-year rally leaves sentiment cautious, but not fragile. With participation returning and positioning reset, the coming weeks will test whether 2026 opens with renewed momentum or a deeper recalibration.

If you value this detailed, weekly market analysis from Prosperiax, please consider sharing this edition with a colleague or friend!

Prosperiax Gold

Prosperiax Gold is the paid extension of the Friday Brief, built for readers who want more than a weekly recap.

Gold members receive two additional emails each week. A Sunday forward-looking game plan that outlines how markets are setting up and what may matter in the days ahead, and a Wednesday check-in that reassesses positioning as conditions evolve.

Prosperiax Gold is designed to bridge the gap between weekly reflection and real-time market shifts, without noise or speculation.