Your Friday Market Brief

Opening Insight

This week was defined by where capital chose to concentrate. While equities continued to grind higher and crypto participation remained selective, the clearest signal came from metals. Gold, silver, and copper all moved with force, reflecting renewed sensitivity to rates, inflation, and real asset scarcity. These were not isolated spikes. They were coordinated moves across inputs tied to physical demand. At the same time, risk appetite stayed measured rather than euphoric. Investors appeared more interested in durability than momentum, favoring assets with tangible linkage as year-end positioning took shape.

Market Recap

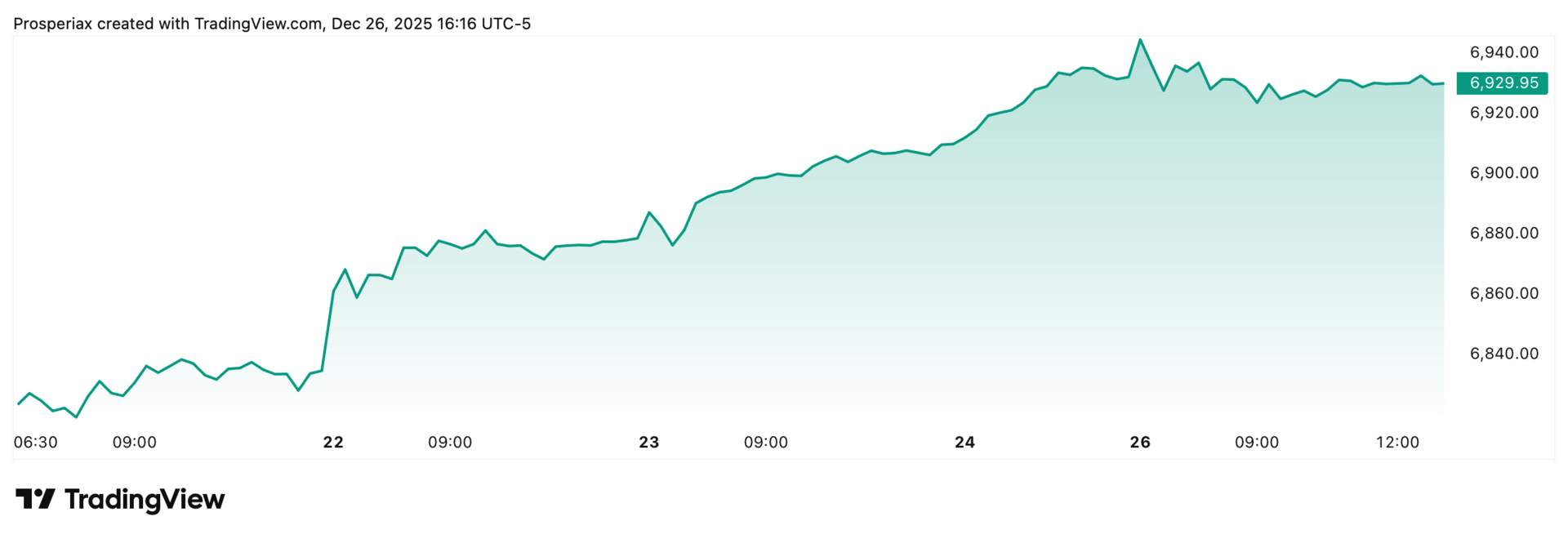

U.S. equities closed the week higher, supported by steady participation across risk assets. The S&P 500 and Nasdaq advanced as technology, financials, and industrials contributed, while defensives lagged. Volatility remained contained despite holiday-thinned liquidity. Bond yields were stable, removing pressure from equities and allowing trends to persist. Flows favored growth and real assets rather than safety, signaling continuation rather than risk-off positioning.

The S&P 500 moved higher on balanced sector participation. Technology and financials led gains, while materials added support as metals surged. Defensive sectors lagged, but breadth remained constructive throughout the week.

The Nasdaq advanced on strength in large-cap technology and semiconductors. Stable yields supported growth positioning, while participation remained selective. Momentum held without excessive volatility despite lighter holiday liquidity.

Stocks That Won The Week

ÖSSUR

$OEZVY

+22.0%

Össur gained as healthcare and prosthetics demand showed resilience. Strength reflected steady fundamentals and defensive appeal amid broader sector rotation.

ZETA GLOBAL

$ZETA

+13.85%

Zeta moved higher as investors rotated back into data-driven advertising platforms. The rally reflected improving sentiment toward ad tech tied to measurable ROI.

LIONSGATE STUDIOS

$LION

+11.85%

Lionsgate advanced as renewed interest in media asset value and studio separation themes supported the stock. The move tracked improved sentiment across select entertainment names.

Stocks That Lost The Week

COREWEAVE

$CRWV

−10.44%

CoreWeave pulled back as AI infrastructure names cooled. The move reflected profit-taking and sensitivity to valuation after a strong prior run.

OKLO

$OKLO

−10.77%

Oklo declined as speculative nuclear names sold off. Momentum faded as investors rotated away from early-stage energy exposure.

LEMONADE

$LMND

−10.07%

Lemonade fell amid renewed pressure on unprofitable growth stocks. The decline tracked broader risk reduction in higher-beta fintech names.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology - $XLK | +2.79% | +25.08% |

Energy - $XLE | -0.27% | +2.20% |

Financials - $XLF | +1.86% | +14.40% |

Industrials - $XLI | +1.63% | +18.45% |

Healthcare - $XLV | +1.35% | +12.83% |

Technology led the week, supported by renewed growth participation. Financials followed as stable yields favored banks. Industrials and materials advanced alongside strength in metals. Healthcare posted modest gains, while energy lagged despite broader commodity strength.

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Crypto Recap

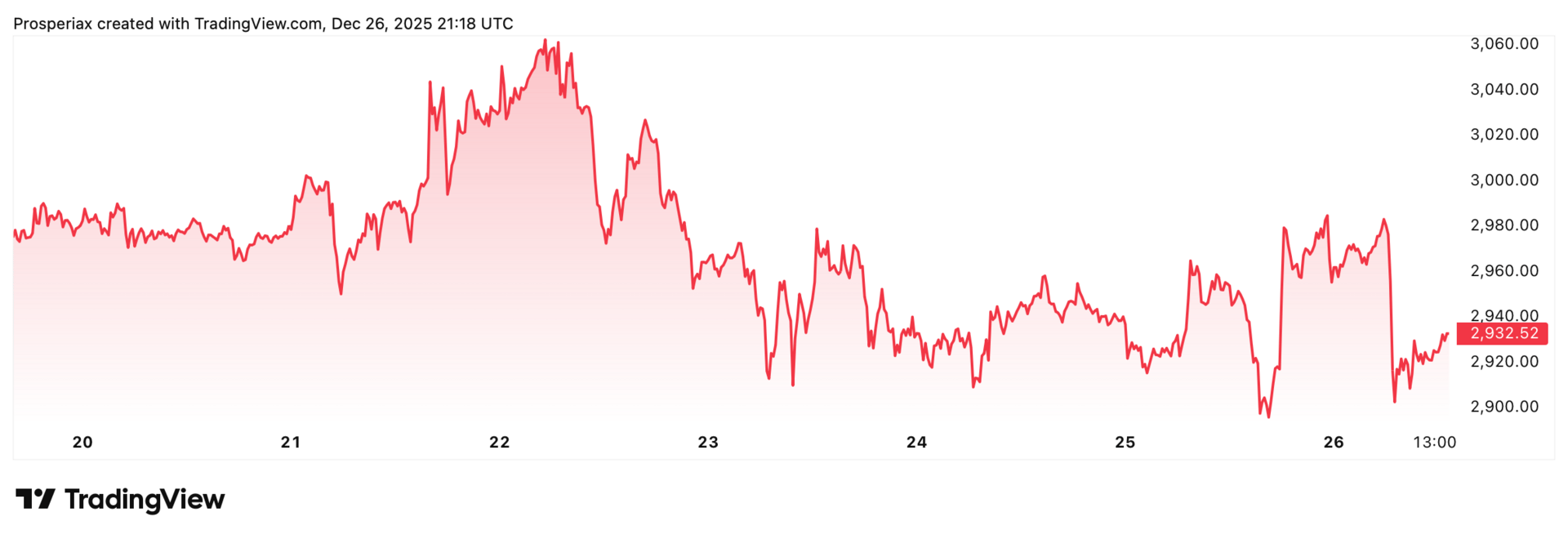

Crypto markets were mixed. Bitcoin and Ethereum posted modest gains, while XRP advanced more decisively. Solana remained flat after prior weakness. Participation stayed selective, with flows favoring larger assets rather than broad risk-on behavior, especially as metals drew increased capital.

$BITUSD 1 Week chart. This chart excludes the Monday morning jump, hence a red chart but positive Weekly percentage change.

$ETHUSD 1 Week chart. This chart excludes the Monday morning jump, hence a red chart but positive Weekly percentage change.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin ($BTC) | +2.46% | -6.22% |

Ethereum ($ETH) | +3.69% | -11.99% |

Solana ($SOL) | −0.04% | −40.72% |

XRP ($XRP) | +2.62% | −10.83% |

Mover Of The Week

Ethreum

Ethereum showed the largest relative move among major assets. After recent weakness, ETH rebounded as selling pressure eased and flows stabilized. The move reflected cautious re-entry rather than renewed momentum, lagging the intensity seen across metals.

Commodities Recap

Commodities led the week. Gold and silver surged sharply, with silver significantly outperforming. Copper extended higher despite elevated levels, reinforcing industrial demand strength. Oil posted modest gains but lagged metals as oversupply concerns remained present.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold - $XAUUSD | +4.44% | +72.50% | Rate sensitivity and safe-haven demand |

Oil - $CL1! | +1.79% | -20.81% | Supply concerns capped price gains |

Copper - $HG1! | +7.58% | +44.85% | Industrial demand drove extension |

Silver - $XAGUSD | +17.90% | +164.46% | Momentum accelerated alongside gold |

Macro Drivers

Metals strength was driven by easing rate expectations, a softer dollar, and renewed inflation sensitivity. Lower real yields increased demand for non-yielding assets, while industrial demand supported base metals. Silver benefited from both monetary and industrial forces, amplifying its move. Oil lagged as supply dynamics continued to outweigh macro tailwinds.

The Headlines Traders Need Before the Bell

Tired of missing the trades that actually move?

In under five minutes, Elite Trade Club delivers the top stories, market-moving headlines, and stocks to watch — before the open.

Join 200K+ traders who start with a plan, not a scroll.

Final Take

This week reinforced a quiet but important shift in market behavior. Participation remained healthy, but it was far more selective than it appeared on the surface. Equities moved higher without excess, crypto stabilized without conviction, and metals delivered the clearest message. Gold, silver, and copper did not move on speculation alone. They moved as investors reassessed sensitivity to rates, inflation persistence, and physical demand heading into the new year. That distinction matters. Markets are not pricing panic, but they are repricing exposure. As liquidity thins and positioning firms up, durability is being rewarded over narrative. The next phase will hinge on whether this preference for real assets deepens or pauses, but the direction of recent flows suggests investors are preparing rather than chasing.

If you value this detailed, weekly market analysis from Prosperiax, please consider sharing this edition with a colleague or friend!

Holiday Special — Prosperiax Gold

For a limited time, Prosperiax Gold is fifty percent off the first billing cycle, monthly or annually. This offer runs through January first.

Prosperiax Gold includes two additional weekly emails: a Sunday forward-looking gameplan outlining what markets may favor in the week ahead, and a Wednesday check-in to reassess positioning as conditions change.