Micron was included on the Prosperiax Gold assets-to-watch list because it reflects a market that is beginning to reward clarity over speculation. At a time when capital is becoming more selective, Micron stands out for reasons that extend beyond price action or narrative alignment.

The company is operating in an environment defined by constrained supply, contracted demand, and earnings visibility that is increasingly rare across technology. Recent strength in the stock is not the result of forward optimism being pulled into price, but of realized fundamentals catching up to a business that has quietly shifted its positioning within the semiconductor landscape.

This report examines why Micron fits the current regime, what its recent behavior suggests about capital allocation today, and why it warrants attention as markets continue to separate durable structure from momentum-driven exposure.

II. Price Action in Context

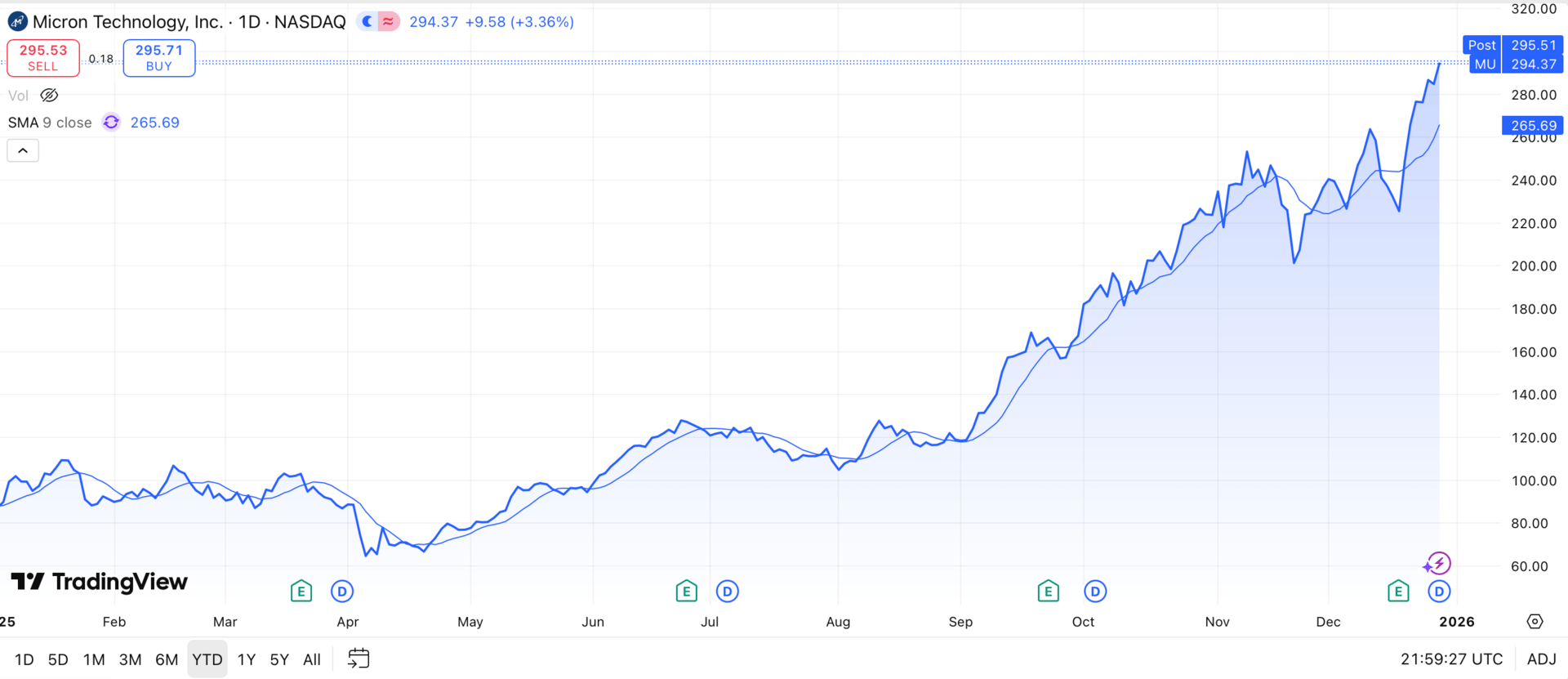

Micron recently pushed to fresh 52-week highs around $289 while broader markets struggled to maintain direction. More notably, the stock advanced even on days when tech and precious metals pulled back, contributing positively to index performance rather than riding broad risk appetite.

That context matters because this was not a speculative surge ahead of earnings. It occurred after Micron delivered one of the strongest quarters in its history.

In fiscal Q1 2026, Micron reported $13.64 billion in revenue and $4.78 in earnings per share, materially above expectations. Management paired those results with guidance that reinforced demand visibility well into 2026.

This is the point where Micron diverges from the usual semiconductor narrative. The market is not extrapolating hope. It is reacting to realized earnings and contracted demand.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

III. A Different Type of Memory Cycle

Memory has always been cyclical. What has changed is the shape of demand.

Micron is operating inside a global memory shortage that is not being driven by consumer pull-forward or inventory mismanagement, but by a reallocation of capacity toward high-margin memory products tied to AI infrastructure. High-bandwidth memory in particular is effectively sold out through 2026.

That detail is doing far more work than most headlines acknowledge.

When capacity is sold out multiple quarters in advance, pricing power is no longer a function of spot demand. It becomes contractual. That gives earnings visibility a level of durability that memory companies historically did not enjoy.

This is why Micron’s results feel different from prior upcycles. The revenue is not just strong. It is scheduled.

IV. Capital Discipline Over Narrative

Micron’s valuation helps explain why it fits the Prosperiax Gold framework.

Despite rising more than 230 percent over the past year, Micron trades at a forward earnings multiple in the high twenties. That remains below many large-cap technology peers whose growth is far less visible and whose margins depend more heavily on continued multiple expansion.

This is not a case of cheap valuation. It is a case of earnings catching up to price.

At the same time, capital expenditure remains elevated. Some commentators have pointed to that as a risk to free cash flow. That concern is fair, but incomplete. In a supply-constrained environment, disciplined reinvestment is not dilution. It is how scarcity is maintained.

This is exactly the type of trade-off Prosperiax Gold pays attention to. The market is rewarding companies that reinvest into bottlenecks rather than chase volume for its own sake.

V. Why Micron Was Included

Micron was included in the Prosperiax Gold assets-to-watch list because it reflects what markets are beginning to favor.

Not stories.

Not optionality.

Not distant promises.

Instead, Micron offers a rare combination of multi-quarter demand visibility, constrained supply, realized earnings strength, and valuation that does not rely on narrative stretch.

Whether the stock continues higher in the near term is less important than what it represents. Micron is an example of how capital is behaving when it becomes more selective.

That behavior is the signal.

VI.

Going forward, Micron becomes a useful barometer.

If pricing power holds and guidance continues to extend, it reinforces the idea that markets are rewarding structure over speculation. If margins compress or capacity assumptions change, it will show up quickly in expectations.

Either way, Micron is worth watching not because it is exciting, but because it is honest.

In this market, that may be the most valuable quality of all.

—

Education, not investment advice.

Sources: