Your Friday Market Brief

Opening Insight

Markets spent most of the week on edge before finally catching their breath. Tuesday's selloff had everyone nervous until Trump showed up in Davos and said what people needed to hear: no military force for Greenland. That was enough. Equities snapped back, tech bounced hard, and suddenly everyone remembered why they liked chips. Nvidia's CEO hinting at a China trip pulled AMD and the whole sector up with it. Intel missing guidance just made the rotation that much cleaner. But here's what actually mattered this week: storage. SanDisk ripped on NAND shortages and the dawning realization that AI data centers can't run on GPUs alone. Sometimes the biggest moves hide in the least obvious places.

Market Recap

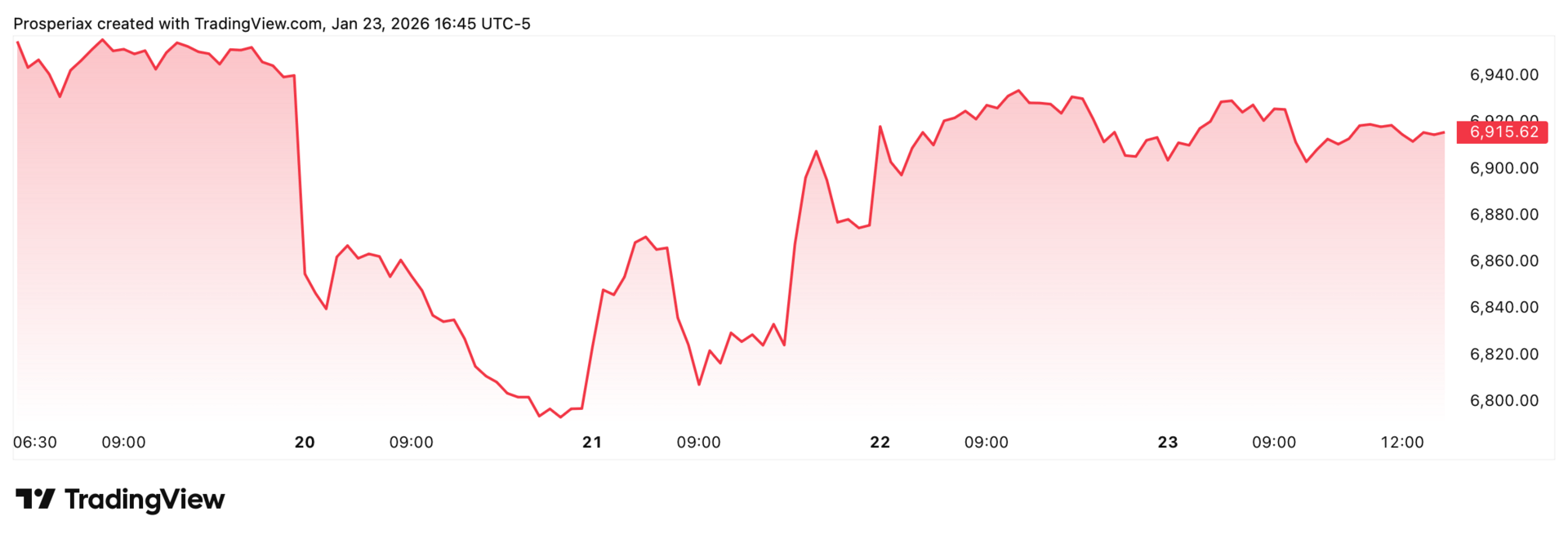

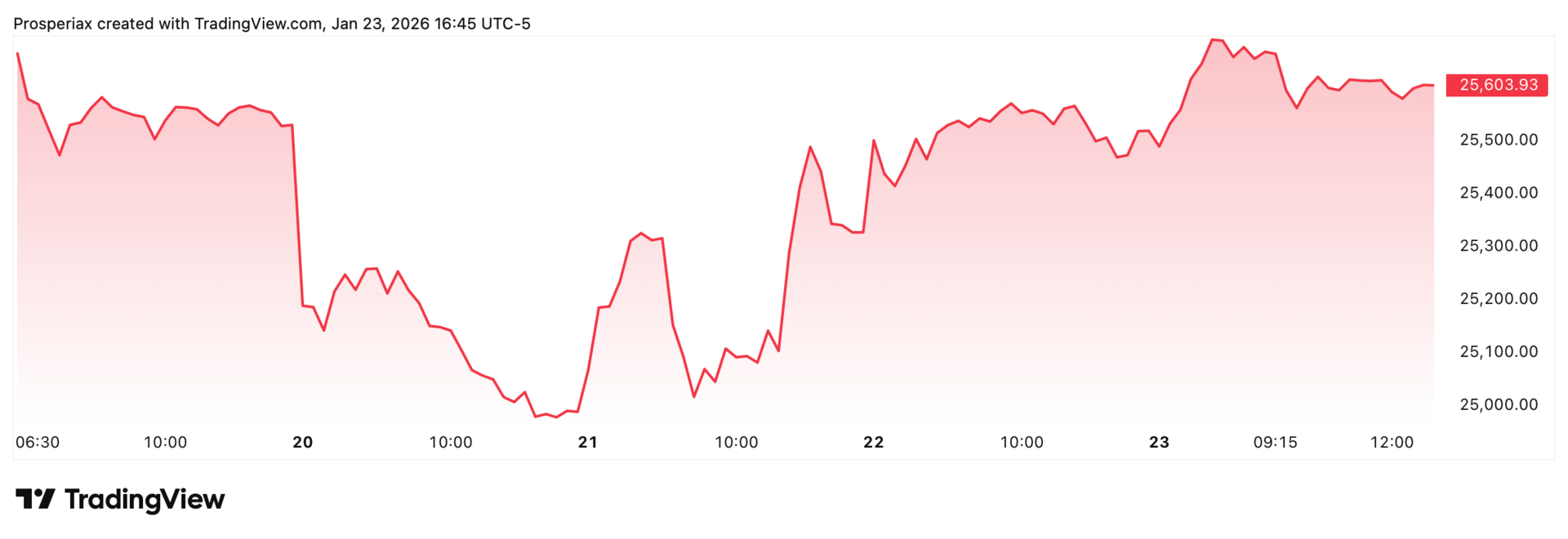

Equities spent the week digesting geopolitical noise before finding footing late. The S&P 500 edged down 0.4% for the week despite Friday's modest gain, marking its second consecutive weekly decline. The Nasdaq followed a similar path, down 0.3% for the week as growth stocks struggled to sustain momentum. Defensive sectors lagged while energy outperformed on crude strength. The week's trading pattern was clear: risk-off Tuesday gave way to risk-on Thursday and Friday as Trump's comments eased tariff and military concerns. Volatility remained elevated, gold hit records, and the dollar stayed weak.

The index closed Friday at 6,915.61, up just 0.03%, effectively flat after intraday swings. Weekly performance of -0.4% reflected persistent uncertainty despite the late-week bounce.

The tech-heavy index gained 0.28% Friday to settle at 23,501.24, but finished the week down 0.3%, unable to overcome Tuesday's geopolitical selloff despite strong chip sector performance.

Stocks That Won The Week

ADVANCED MICRO DEVICES

$AMD

+14.72%

Intel's weak guidance sent investors scrambling for alternatives. AMD benefited from the rotation, amplified by news that Nvidia's CEO would visit China, signaling potential market reopening.

SANDISK CORPORATION

$SNDK

+14.97%

NAND memory shortage met AI infrastructure demand. Jensen Huang's CES comments on storage as the "largest unserved market" in AI triggered massive flows. Supply-constrained pricing drove the rally.

DATADOG

$DDOG

+10.90%

Tech relief trade lifted cloud monitoring names as Trump ruled out military force for Greenland. The tariff suspension removed immediate headwinds, and growth stocks rebounded on easing tensions.

Stocks That Lost The Week

ABBOTT LABORATORIES

$ABT

-11.97%

Fourth-quarter revenue miss ($11.46B vs $11.80B expected) triggered the selloff. Diagnostics weakness persisted post-COVID, and nutrition segment struggles compounded concerns. 2026 guidance disappointed despite strong medical devices performance.

ROBLOX CORPORATION

$RBLX

-12.34%

Management's cautious tone on 2026 growth visibility spooked investors already concerned about margin compression. Legal challenges and platform outages added pressure. Still unprofitable on GAAP basis despite strong user metrics.

KRATOS DEFENSE & SECURITY SOLUTIONS

$KTOS

-13.72%

ARK Funds sold positions as Trump's Greenland rhetoric raised fears of European defense contract disruption. Broader defense sector selloff accelerated profit-taking after the stock's 49% YTD rally.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology - $XLK | +0.93% | -0.41% |

Energy - $XLE | +2.48% | +9.89% |

Financials - $XLF | -1.47% | -3.20% |

Industrials - $XLI | -0.86% | +5.53% |

Healthcare - $XLV | +1.73% | +1.69% |

Energy led with 2.48% weekly gains, tracking crude's move above $77 as supply concerns persisted. Healthcare fell 1.73%, dragged by Abbott's miss and broader medtech weakness. Financials dropped 1.47% on Goldman's decline and rate uncertainty. Technology managed a modest 0.93% gain despite Tuesday's volatility, as chips outperformed. Industrials slipped 0.86% on Caterpillar weakness and cautious capital expenditure sentiment.

Get the investor view on AI in customer experience

Customer experience is undergoing a seismic shift, and Gladly is leading the charge with The Gladly Brief.

It’s a monthly breakdown of market insights, brand data, and investor-level analysis on how AI and CX are converging.

Learn why short-term cost plays are eroding lifetime value, and how Gladly’s approach is creating compounding returns for brands and investors alike.

Join the readership of founders, analysts, and operators tracking the next phase of CX innovation.

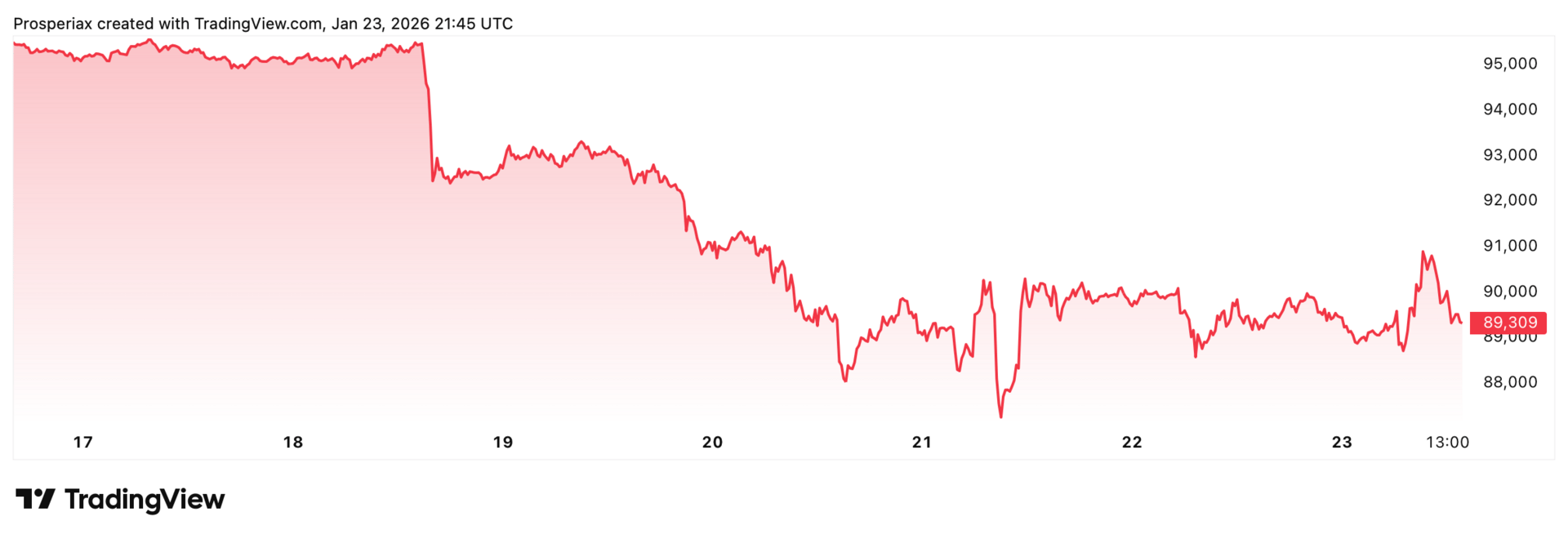

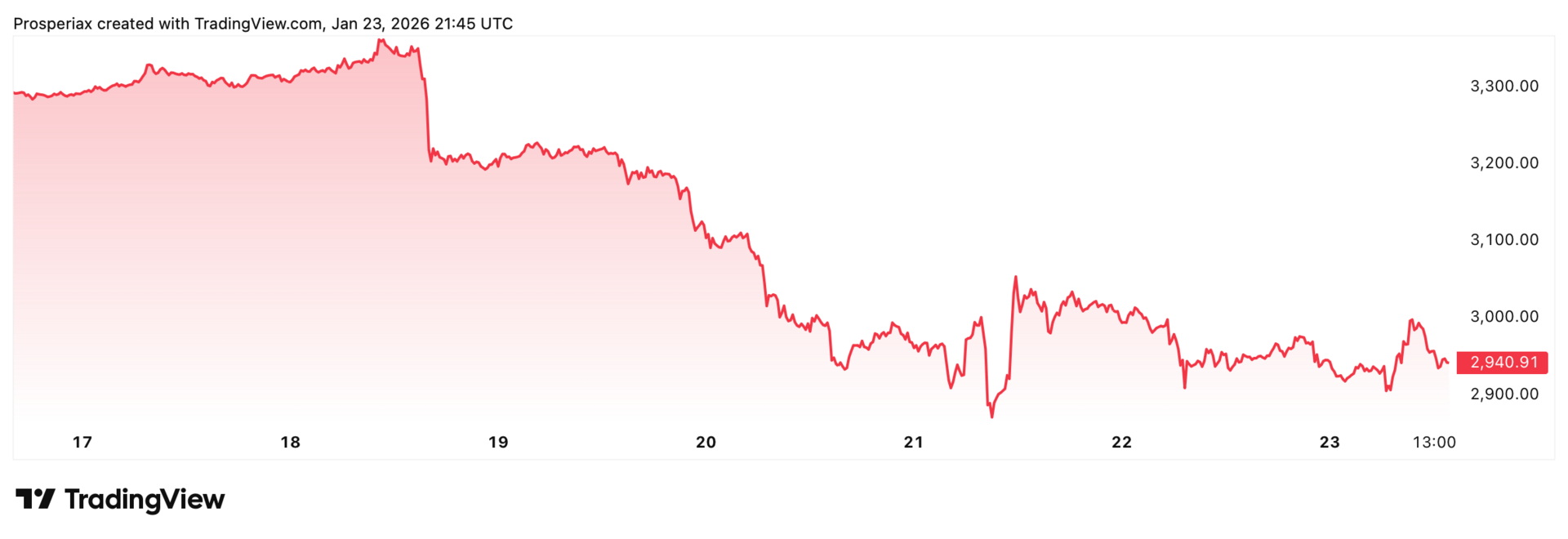

Crypto Recap

Bitcoin slipped 1.70% to close near $90,000, unable to reclaim psychological support despite equity market stabilization. Solana and XRP showed relative strength, down 1.59% and 0.70% respectively. Ethereum led declines at -4.18%, pressured by ETF outflows and continued competition from alternative Layer-1s. The broader market consolidated in tight ranges as leveraged liquidations flushed weak hands. Fear sentiment dominated with the Crypto Fear & Greed Index approaching neutral at 41, down from 43.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin ($BTC) | -1.70% | +2.15% |

Ethereum ($ETH) | -4.18% | -0.99% |

Solana ($SOL) | -1.59% | +1.46% |

XRP ($XRP) | -0.70% | +4.25% |

Mover Of The Week

ETHEREUM

ETH underperformed as institutional flows reversed and macroeconomic uncertainty kept liquidity tight. Range-bound trading near $3,000-$3,300 reflected hesitation rather than capitulation. Competition from Solana and concerns about network activity relative to rivals added pressure. Technical breakdown below key support triggered algorithmic selling. Despite strong fundamentals in staking and tokenization, price action remained weak as traders awaited clearer direction.

Commodities Recap

Precious metals extended their rallies as safe-haven demand persisted. Gold surged 5.21% to record highs, driven by year-end profit-taking cycles meeting geopolitical uncertainty. Silver jumped 8.41%, the week's standout performer, as margin hikes triggered volatility and speculative positioning accelerated. Copper gained 2.42% on industrial optimism, particularly tied to data center buildout. Oil rose 1.63% to $77.45, supported by oversupply concerns despite soft seasonal demand. The sector reflected ongoing macro uncertainty and infrastructure investment themes.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold - $XAUUSD | +5.21% | +15.22% | Safe-haven buying drove record highs |

Oil - $CL1! | +1.63% | +6.62% | Supply concerns offset weak demand |

Copper - $HG1! | +2.42% | +4.14% | Data center buildout lifts prices |

Silver - $XAGUSD | +8.41% | +41.19% | Speculative flows fuel explosive rally |

Macro Drivers

Safe-haven flows dominated precious metals as investors positioned for policy uncertainty and geopolitical risk. Gold's record run reflected both dollar weakness and central bank buying, while silver's explosive move suggested speculative leverage amplifying underlying trends. Industrial metals benefited from AI infrastructure narratives, with copper's gains tied to data center construction and electrical grid expansion. Energy markets balanced oversupply concerns against potential demand recovery, with oil's modest gain reflecting tight physical markets despite bearish inventory data. The commodity complex signaled mixed conviction—defensive positioning in precious metals, cautious optimism in industrials.

Write PRDs and tests by voice

Dictate PRDs, acceptance tests, and bug reproductions inside Cursor or Warp and get paste-ready text. Wispr Flow auto-tags file names and preserves variable names so your technical writing stays precise. Try Wispr Flow for engineers.

Final Take

Strip away the noise and this week told a pretty straightforward story. Geopolitical tension created an opening, and storage stocks proved that AI infrastructure is about more than just processors. Trump walking back the Greenland rhetoric in Davos gave markets permission to bounce, but how fast it happened suggests we were already oversold. What's worth paying attention to is the stuff under the surface. SanDisk didn't rally on hype. It rallied because the AI buildout needs memory and no one's been talking about it. Meanwhile, Ethereum down 4% and Abbott missing on revenue weren't random. They were reality checks for narratives that got ahead of themselves. Energy holding gains and gold hitting records tells you people are hedging even while they're buying growth. Next week's question isn't whether we stabilize. It's whether this holds when liquidity gets tighter and companies actually have to deliver. Trump paused tariffs, but that's a delay, not a resolution.

If you value this detailed, weekly market analysis from Prosperiax, please consider sharing this edition with a colleague or friend!

Prosperiax Gold

The Friday Brief covers what happened. Gold tells you what matters next.

Gold members get two additional emails every week: a Sunday setup that maps the week ahead before markets open, and a Wednesday mid-week read that adjusts as conditions shift.

No speculation. No noise. Just positioning intelligence between the headlines.