I.

Silver is currently exhibiting a divergence between futures pricing and physical acquisition costs that warrants structural analysis. Financial markets continue to price silver primarily through futures contracts optimized for liquidity, leverage, and risk transfer, while physical markets are clearing at higher levels driven by availability, logistics, and demand for possession. This gap has reignited claims of manipulation, but the more analytically useful question is not whether silver is being controlled, but how its market structure allows two clearing mechanisms to respond differently under stress. This report examines that structure, historical precedents for similar divergences, and what such conditions tend to signal when liquidity, trust, and ownership begin repricing simultaneously.

II. Silver’s Dual Market Structure

Silver does not trade in a single unified market. It trades through layered systems designed to solve different problems.

The futures market exists to transfer price risk efficiently. It is capital-driven, not inventory-driven. Contracts are predominantly settled financially rather than physically, and pricing reflects positioning, funding conditions, margin requirements, and liquidity depth.

The physical market, by contrast, exists to transfer ownership. Pricing reflects fabrication capacity, transport constraints, inventory willingness, and immediacy of delivery. These markets operate in parallel, not hierarchy.

Under stable conditions, the two converge closely enough that the distinction fades. Under stress, convergence is not required.

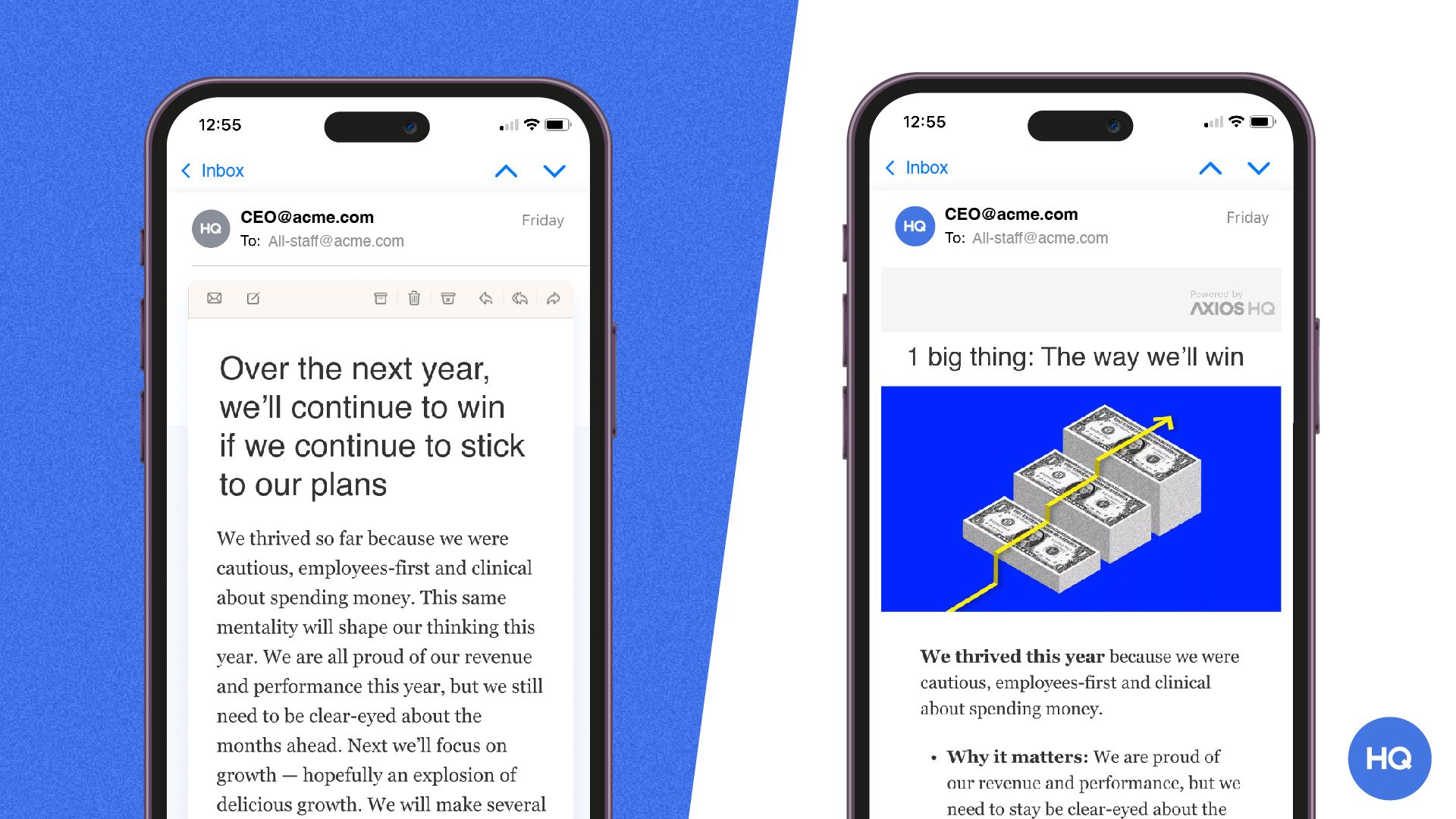

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

Physical silver supply chains are structurally narrow. Minting capacity, transport, and distribution bottlenecks surface quickly when demand accelerates. These constraints express themselves first through premiums rather than headline price changes.

Futures markets can absorb demand through paper positioning without requiring immediate delivery. That capacity delays price response even when physical acquisition costs rise. The resulting gap between futures pricing and physical clearing is a feature of the system, not evidence of malfunction.

IV. Historical Precedent and Market Behavior

This pattern has appeared before. During the 2008 financial crisis, physical silver premiums expanded sharply as confidence in intermediated claims weakened. Futures prices lagged the shift in behavior. Delivery stress emerged before volatility, not after.

The subsequent repricing was neither linear nor isolated. It resolved through broader financial stress rather than through silver markets alone. Silver oscillated between its monetary and industrial roles, exposing its sensitivity to changing risk perceptions.

V. Manipulation Claims and Institutional Findings

Claims of manipulation persist because silver has a documented history of episodic misconduct, including spoofing cases and enforcement actions in precious metals markets. That history lowers the threshold for suspicion when divergences appear.

However, regulatory investigations have repeatedly failed to demonstrate sustained, coordinated suppression of silver prices over long horizons. While misconduct can occur at the margin, futures and physical prices have remained structurally linked over time.

The gap between personal experience and institutional conclusions is where distrust forms.

VI. Competing Incentives Under Stress

The current divergence reflects competing participant objectives rather than unified intent. Some participants are optimizing for liquidity, capital efficiency, and hedging flexibility. Others are prioritizing possession and counterparty reduction.

Silver is unusually sensitive to this conflict because it is small, industrially consumed, financially exposed, and historically monetary. When uncertainty rises, these incentives pull in different directions.

VII. Implications Beyond Silver

Market fragmentation rarely remains isolated. When assets begin clearing at different levels depending on use case, assumptions are being tested. Price ceases to function as consensus and begins functioning as negotiation.

Silver often surfaces this condition early because it occupies an ambiguous role within the financial system.

VIII.

Silver does not require manipulation to trade uncomfortably. It requires only that participants begin solving different problems at the same time. When that occurs, divergence is not anomalous. It is diagnostic.

Historically, such diagnostics precede adjustment. The adjustment does not always arrive where attention is focused.

—

Education, not investment advice.

Sources: