Most people lose confidence in investing because they are staring at numbers they do not understand. P/E ratios, PEG ratios, moving averages, market cap. It all looks technical, but in reality, these numbers are simply answers to a few basic questions.

Is the company expensive or reasonable?

Is it growing fast enough to justify its price?

Is the balance sheet healthy?

Is the stock acting well in the market?

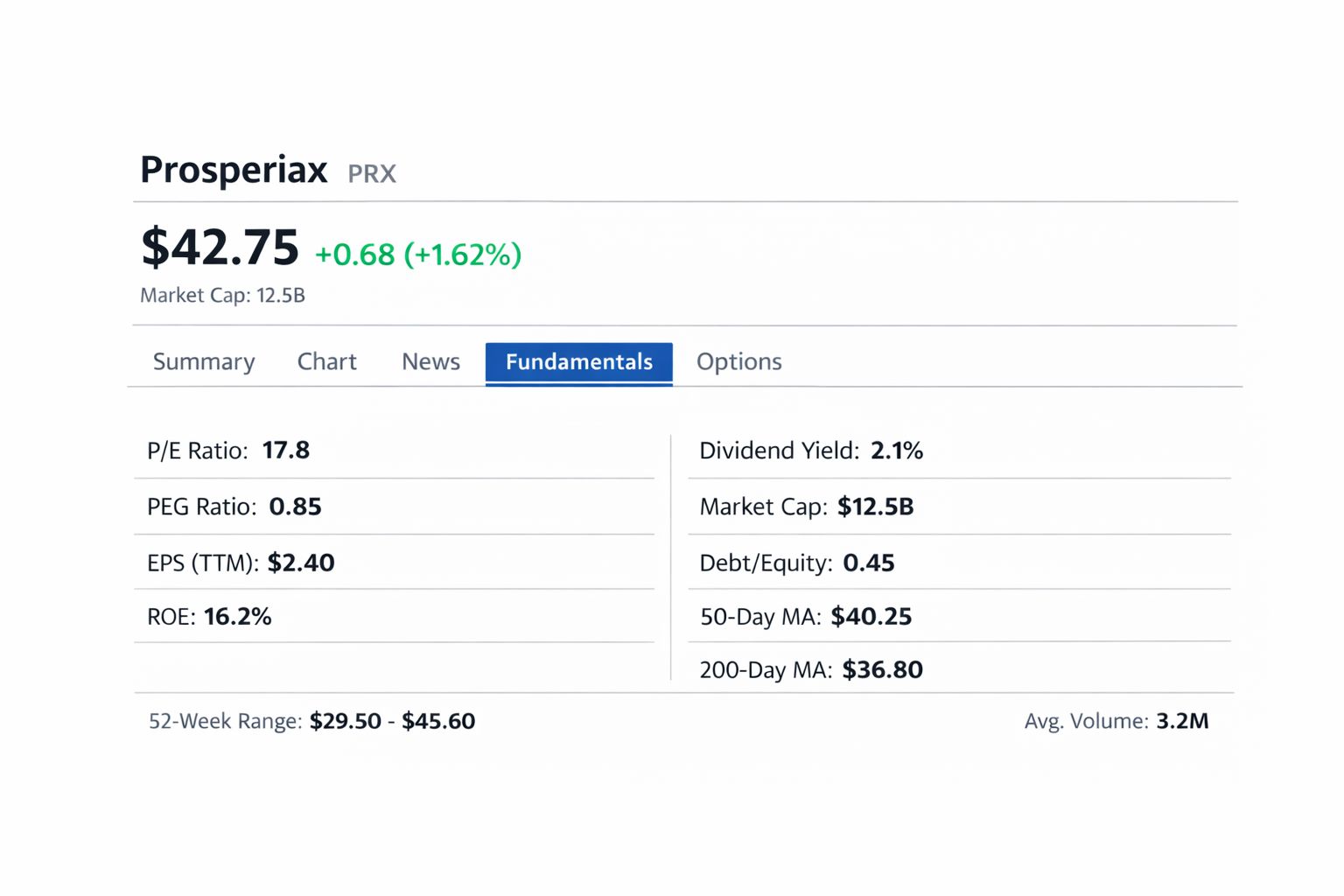

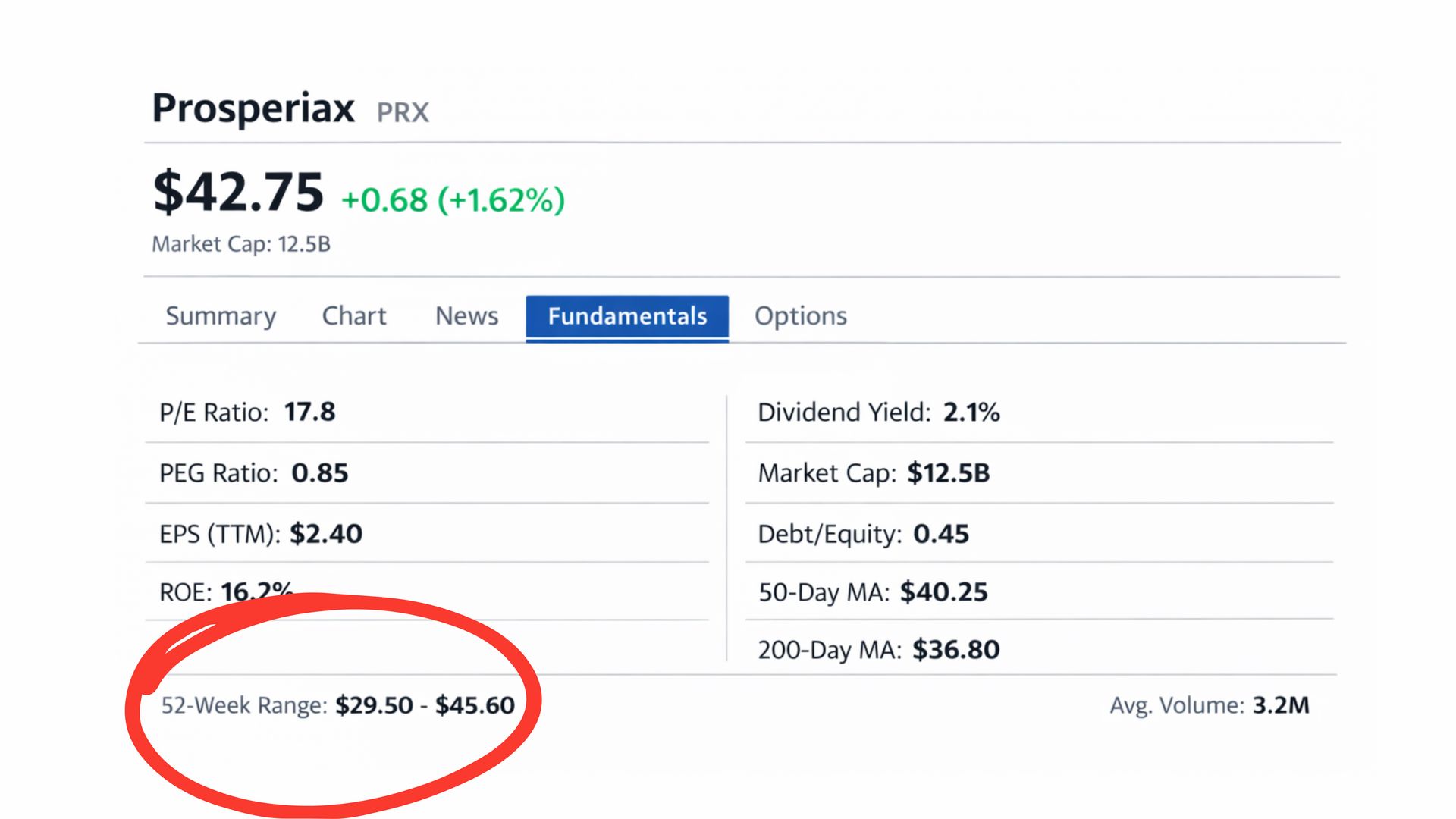

To show how this works in practice, we are going to walk through a single fundamentals page step by step using the greatest company, Prosperiax (PRX). This is not about picking a stock. It is about learning how to read one.

I. Price and Market Context

At the top of the image, Prosperiax is trading at $42.75, up 1.62% on the day.

This tells you two immediate things.

First, the stock is liquid and actively traded. It is moving, not dormant.

Second, the market is currently willing to pay more for it than it did yesterday.

The market cap is $12.5 billion, which places Prosperiax firmly in mid-cap territory. This matters because mid-cap stocks often sit in the balance between growth and stability. They are no longer fragile startups, but they still have room to expand.

Before looking at any ratios, you already know what kind of company you are dealing with.

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

II. Valuation: Is the Stock Expensive?

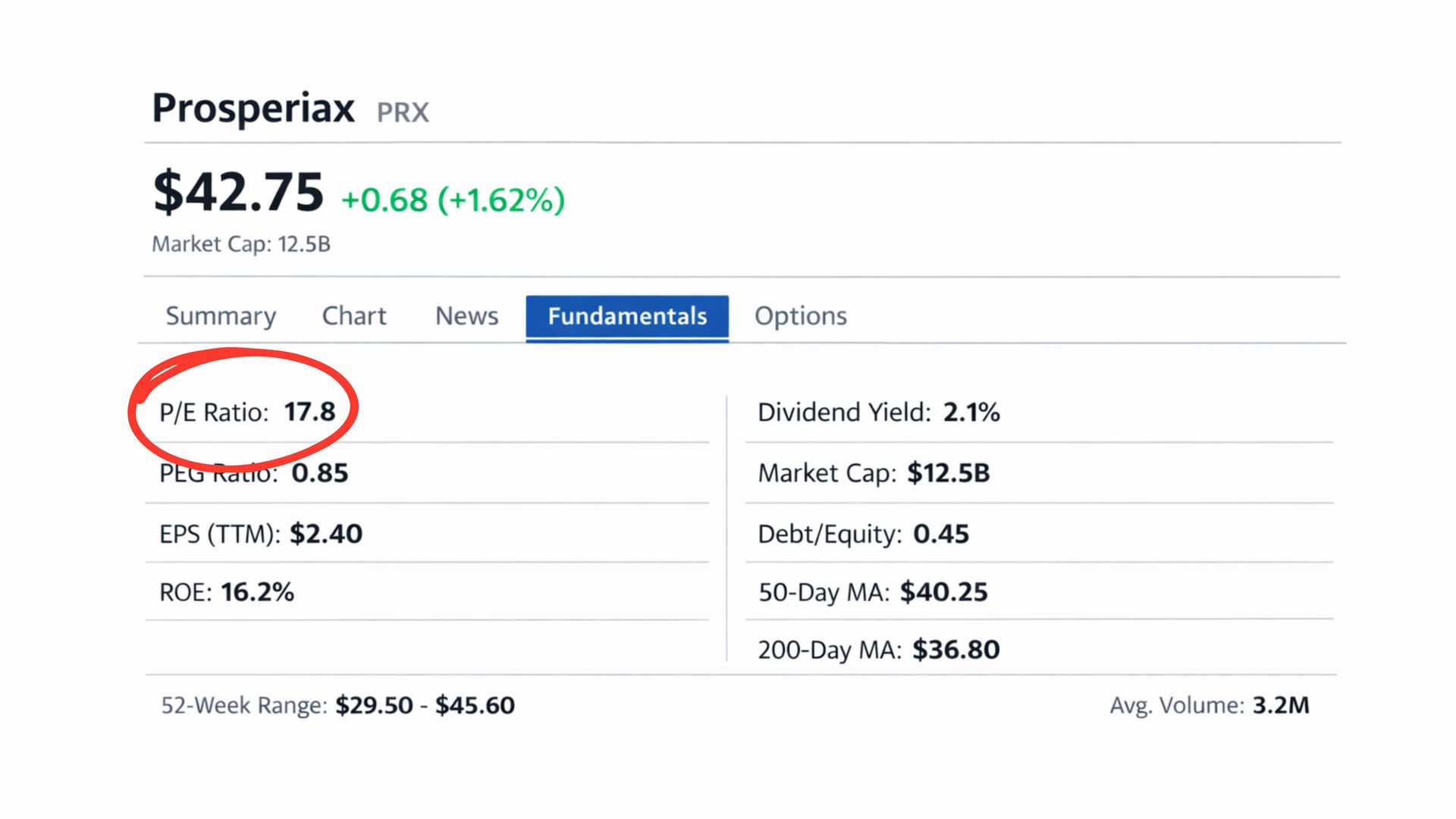

Now look at the P/E ratio of 17.8.

The P/E ratio tells you how much investors are paying for one dollar of earnings. A P/E of 17.8 means the market is paying $17.80 for every $1 the company earns annually.

On its own, this number means nothing. In context, it matters.

For a mid-cap company, a P/E under 20 is generally considered reasonable. It suggests the stock is not priced for perfection. Investors are not assuming explosive growth, but they are also not expecting decline.

This is where many beginners stop. They should not.

III. Growth Adjusted Valuation (PEG)

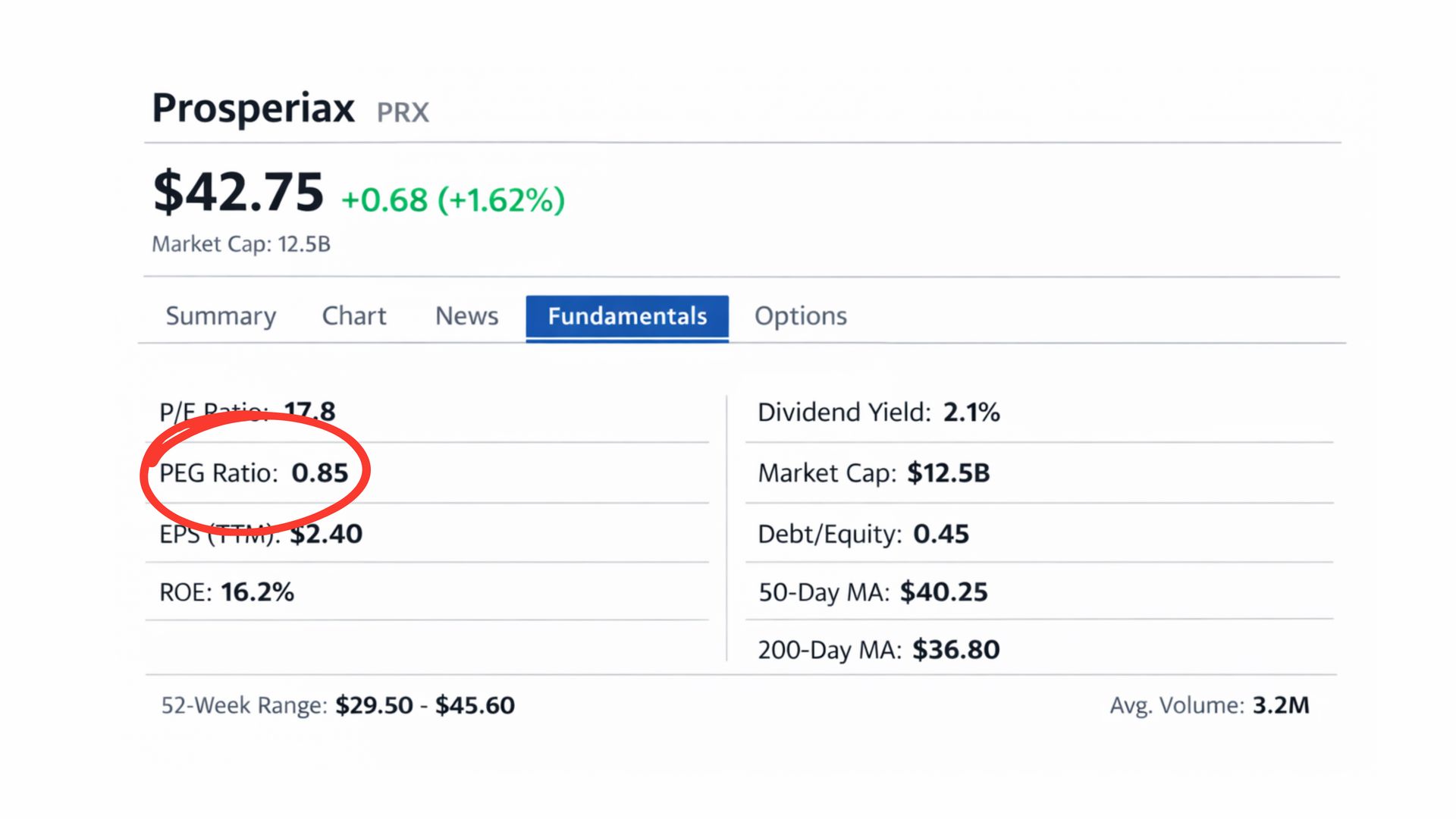

Right below the P/E is the PEG ratio of 0.85.

This is one of the most important numbers on the page.

The PEG ratio adjusts valuation for growth. A PEG below 1 means the company’s expected growth rate is higher than what its P/E implies.

In simple terms, Prosperiax is growing faster than its price suggests.

This does not mean the stock must go up. It means the valuation is not stretched relative to growth. For long-term investors, this is often where interest begins.

IV. Earnings Power

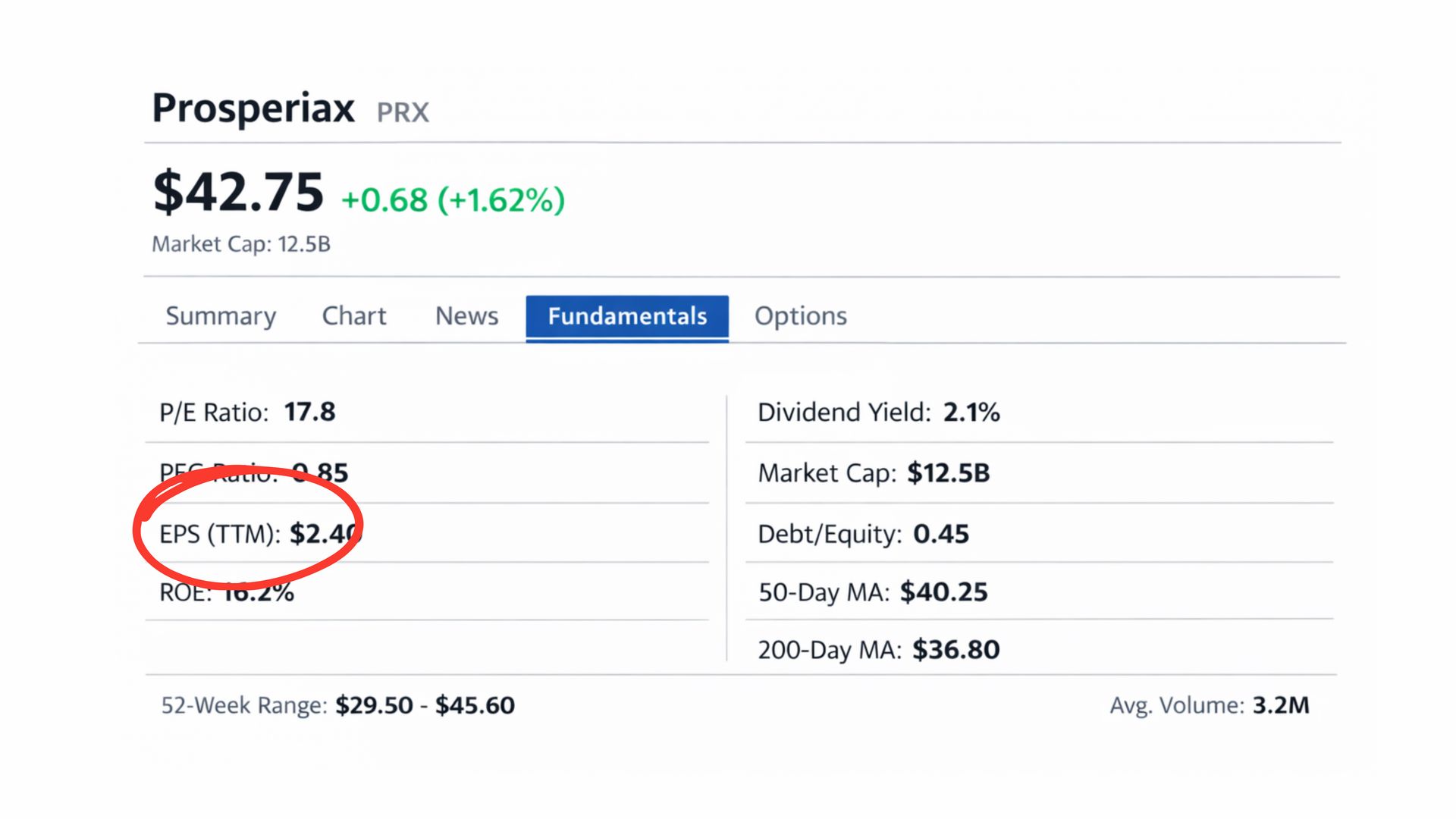

Next, look at EPS (TTM) of $2.40.

EPS shows how much profit the company generated per share over the last twelve months. This is real performance, not projections.

At a price of $42.75, that $2.40 in earnings is what feeds into the P/E calculation. More importantly, it shows the company is profitable and consistently so.

Many stocks trade on hope. This one trades on earnings.

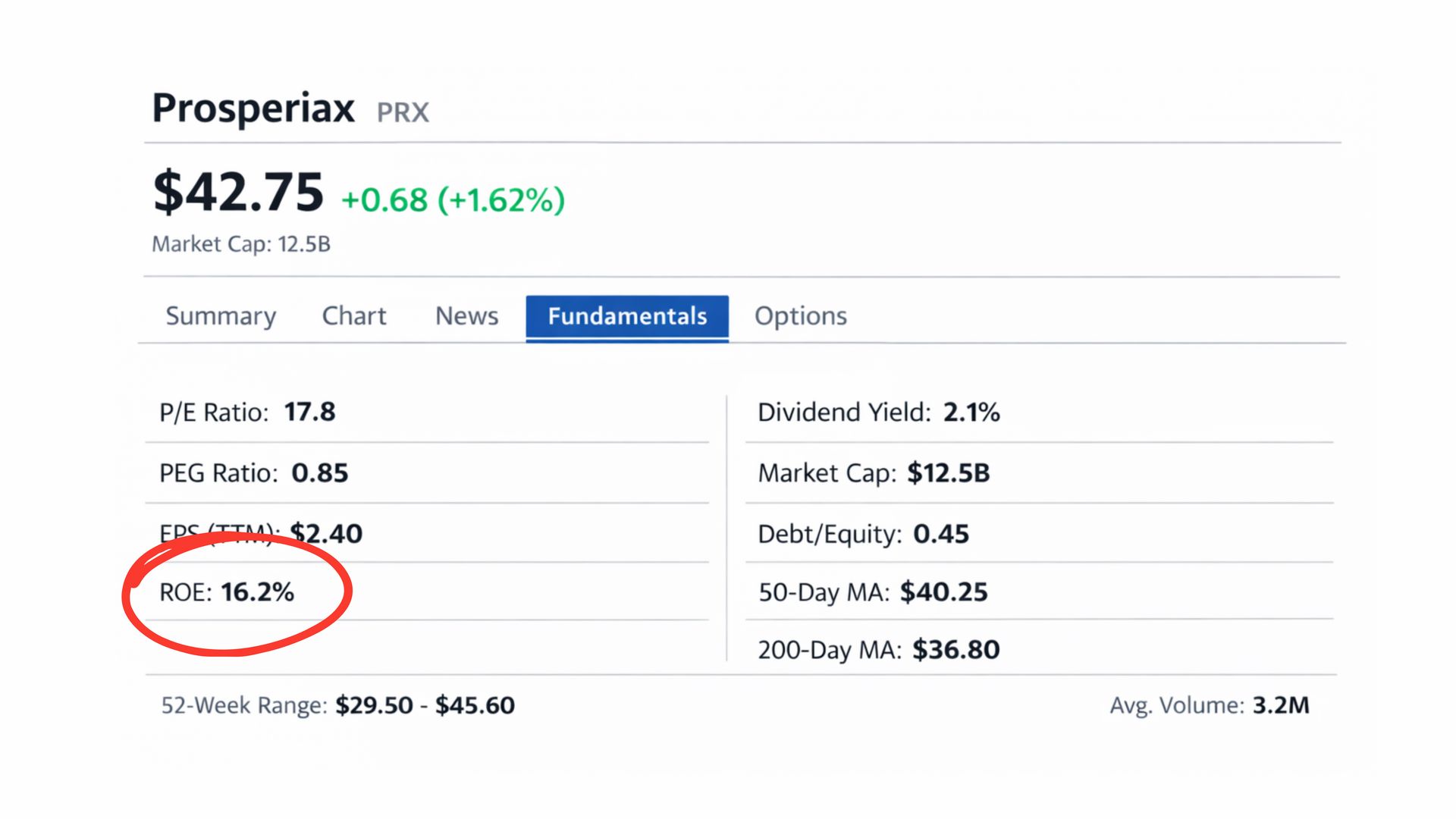

V. Profitability and Efficiency

Now move to ROE of 16.2%.

Return on equity tells you how efficiently management is using shareholder capital. A ROE above 15% is generally considered strong, especially for a company of this size.

This suggests Prosperiax is not just earning money, but doing so efficiently without excessive waste or leverage.

High ROE paired with reasonable debt is a strong internal signal.

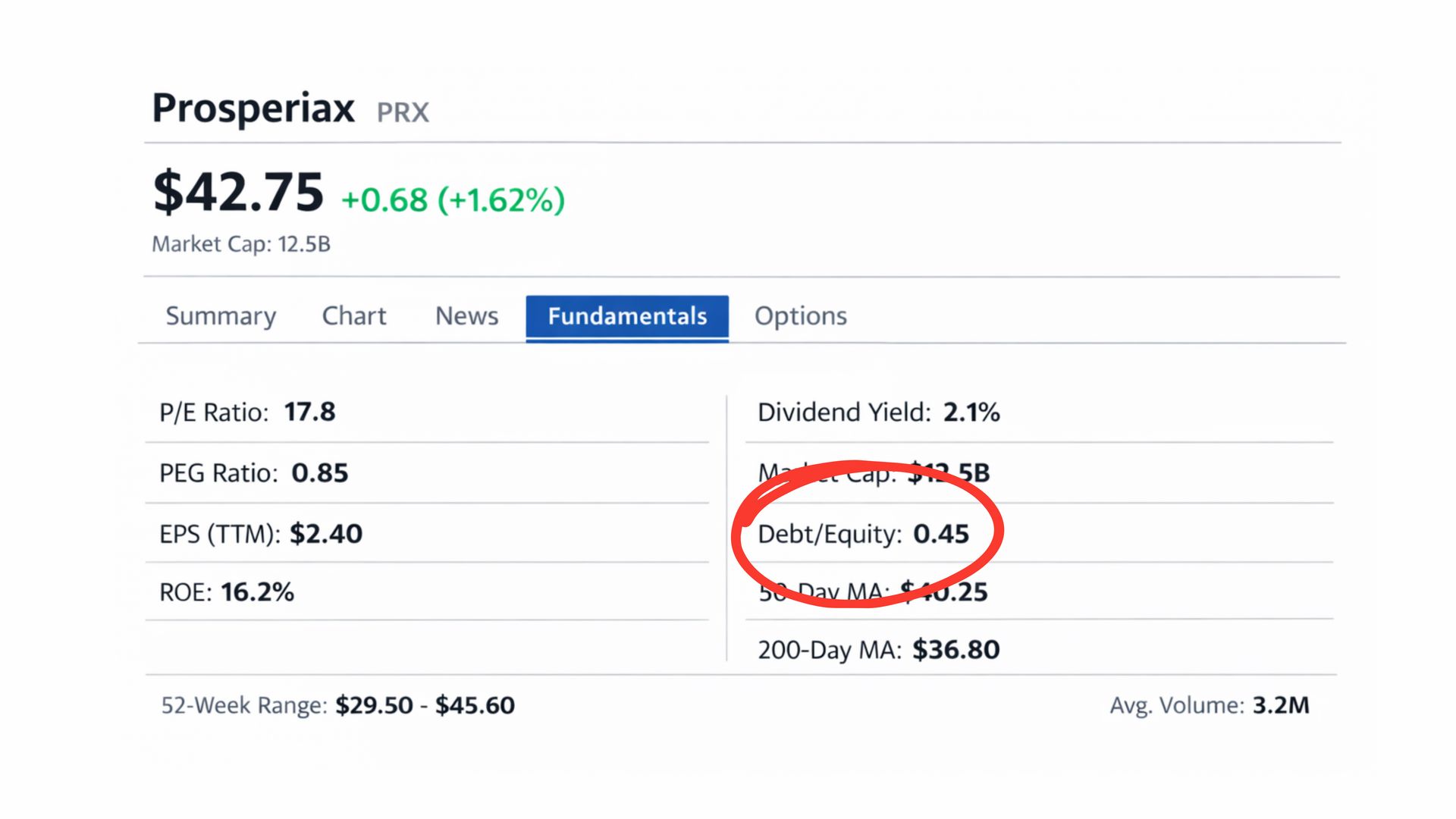

VI. Balance Sheet Health

On the right side of the image, you see Debt to Equity of 0.45.

This means the company has less than fifty cents of debt for every dollar of equity.

That matters.

It tells you Prosperiax is not reliant on heavy borrowing to operate or grow. In higher rate environments or economic slowdowns, this kind of balance sheet provides flexibility and survivability.

Many stocks fail here. This one does not.

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

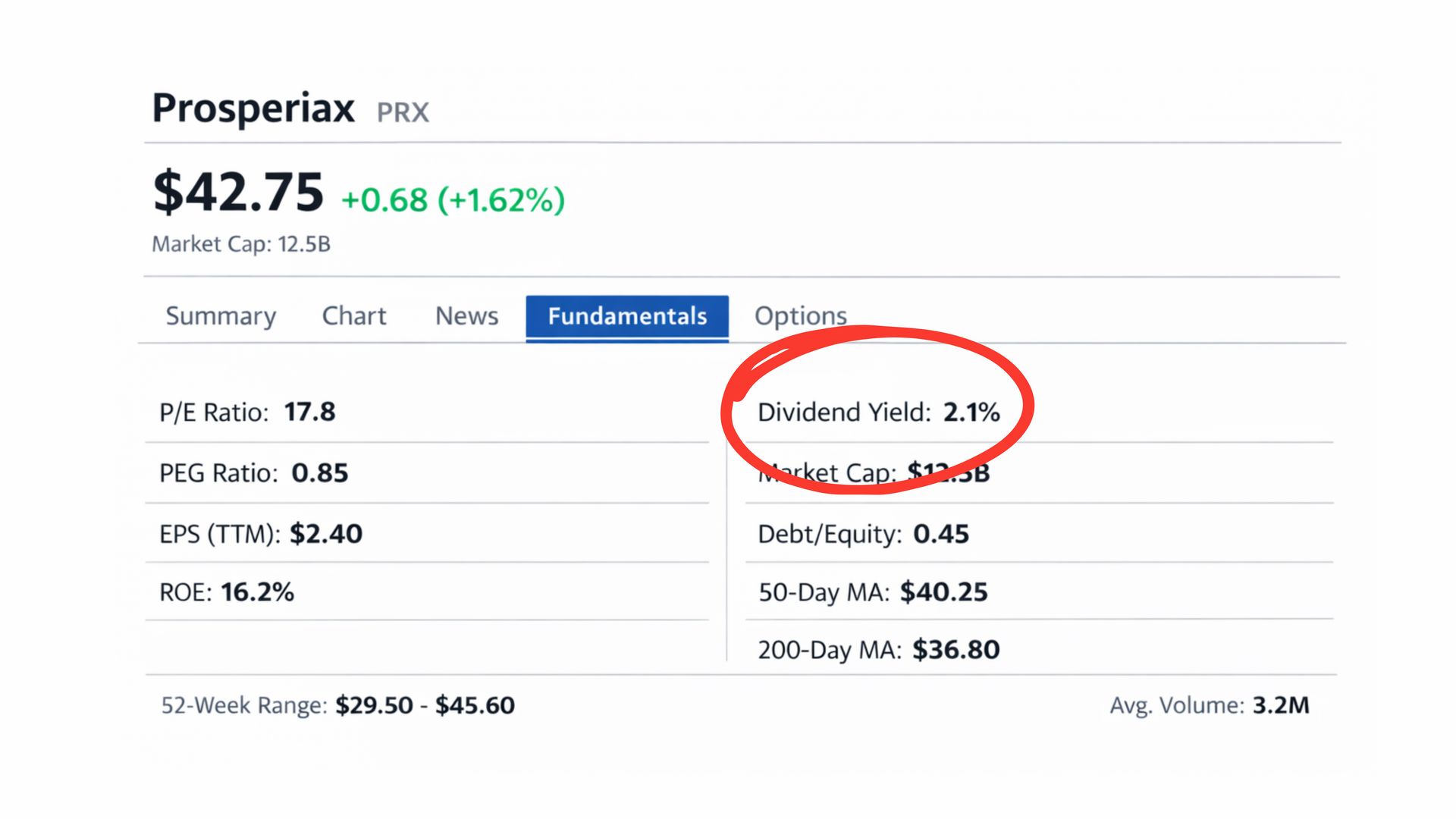

VII. Income Component

Prosperiax pays a dividend yield of 2.1%.

This is not high enough to classify it as an income stock, but it is meaningful. It tells you the company generates enough free cash flow to return capital to shareholders while still reinvesting in the business.

For beginners, dividends serve one important role. They prove profitability is real.

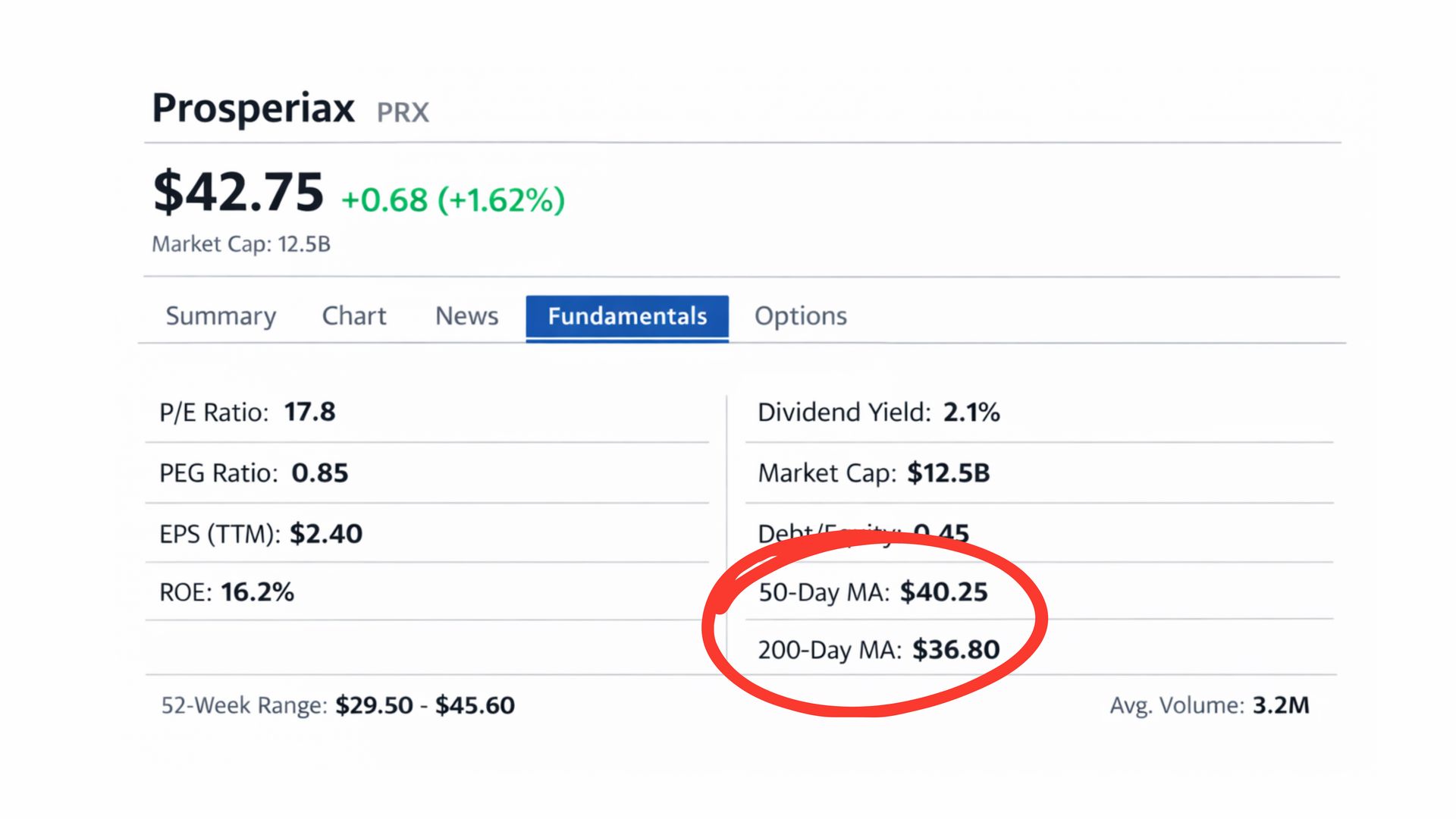

VIII. Technical Context: Trend Matters

Finally, look at the moving averages.

The 50-day moving average is $40.25.

The 200-day moving average is $36.80.

With the stock trading at $42.75, price is above both averages. This indicates an established upward trend.

Fundamentals tell you whether a company deserves investment. Price action tells you whether the market agrees.

Here, the market agrees.

IX. Range and Liquidity

The 52-week range is $29.50 to $45.60.

Prosperiax is trading near the upper end of its yearly range, which tells you sentiment has improved meaningfully over the past year.

Average volume is 3.2 million shares, confirming liquidity. This is not a stock that traps investors.

Evaluating a stock is not about finding a perfect number. It is about stacking reasonable answers.

Prosperiax shows:

Reasonable valuation

Growth that justifies its price

Strong profitability

Controlled debt

Positive price trend

This is how professionals read a fundamentals page. One metric at a time. One question at a time.

Once you understand this process, the numbers stop being intimidating. They start telling a story you can actually follow.

—

Education, not investment advice.