Periods of rising war risk do not force markets to guess outcomes. They force markets to reprice certainty. When geopolitical tension moves from abstract risk to sustained reality, capital begins favoring businesses with locked-in demand, sovereign-backed revenue, and multi-year visibility that is largely insulated from economic cycles.

That shift is visible again heading into 2026. Defense budgets are no longer reactive. They are embedded, forward-funded, and politically durable. Procurement has moved away from one-off replenishment and toward long-horizon capacity building, spanning munitions, platforms, communications, and infrastructure. For markets, this changes how certain companies are valued. Earnings stability, backlog quality, and contract duration begin to matter more than growth narratives or macro sensitivity.

This report focuses on five publicly traded defense companies whose financial structures, contract exposure, and backlog composition position them to benefit when war risk becomes persistent rather than episodic. The goal is not to predict conflict escalation, but to identify where capital historically concentrates when uncertainty rises and governments become the dominant buyer.

Lockheed Martin $LMT

Lockheed Martin remains the largest defense contractor globally and one of the most direct beneficiaries of elevated defense budgets. In 2024, the company reported net sales of $71.0 billion, representing year-over-year growth of roughly five percent. More important than revenue growth is visibility. Lockheed ended the year with a record backlog of approximately $176 billion, reflecting long-cycle programs that extend well beyond near-term conflict headlines.

Recent results reinforce that stability. In the first quarter of 2025, Lockheed reported revenue of $17.96 billion and net income of $1.71 billion, with management reaffirming full-year guidance. Demand for its core platforms remains persistent across multiple theaters, supported by allied procurement and replenishment needs.

From a capital markets perspective, Lockheed benefits from a revenue mix dominated by long-term government contracts. That structure tends to dampen earnings volatility during periods of macro stress, which historically supports relative equity performance when risk premiums rise.

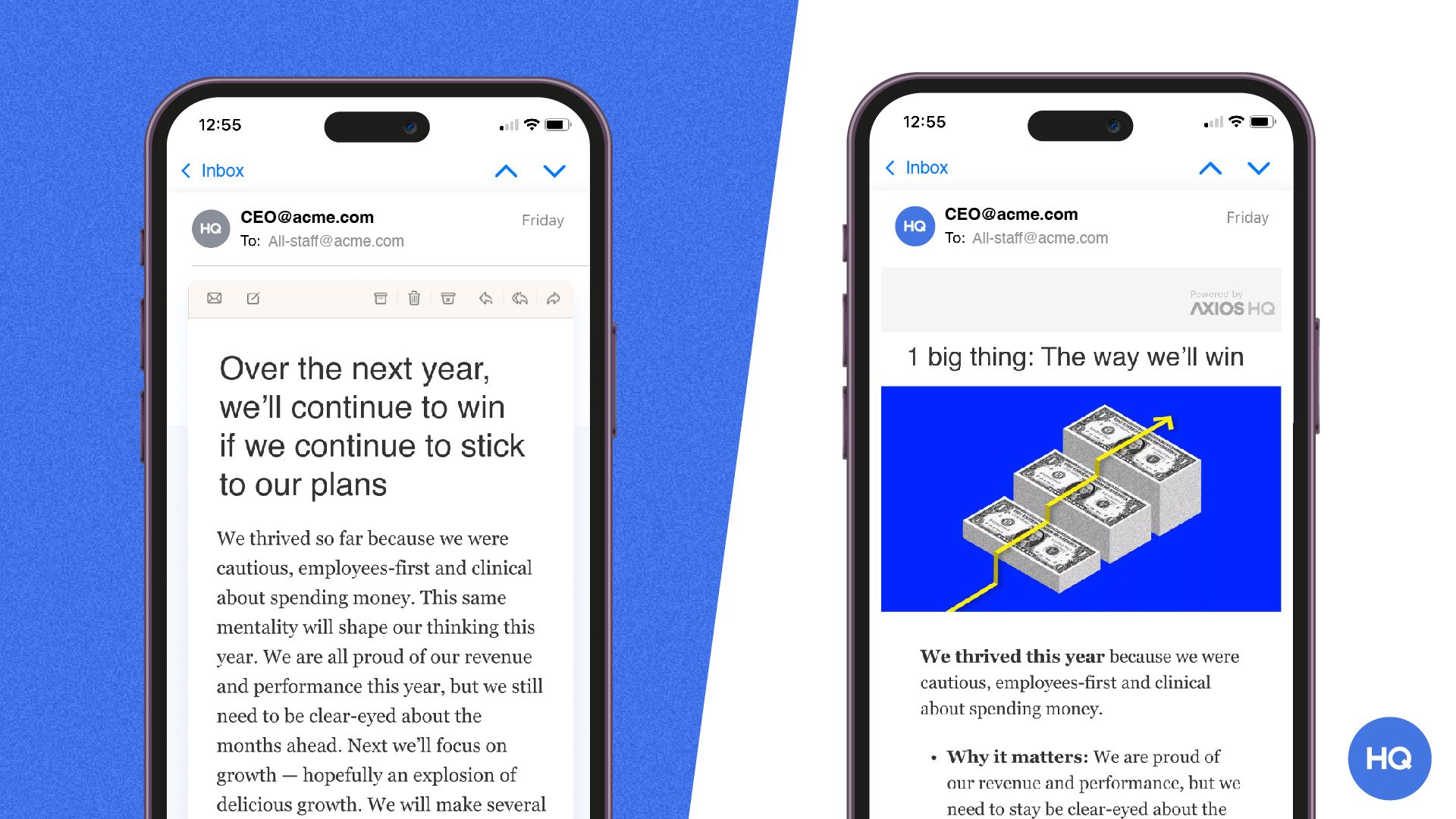

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

Northrop Grumman $NOC

Northrop Grumman occupies a more specialized position within the defense ecosystem, with a focus on strategic systems, aerospace platforms, and missile defense infrastructure. In late 2024, the company raised its full-year sales outlook to approximately $41.4 billion, citing a strong backlog and sustained global demand.

Quarterly results support that outlook. In the second quarter of 2024, Northrop reported revenue of $10.22 billion, up seven percent year over year, alongside meaningful earnings growth. Notably, the company reported profit growth of over twenty percent in ammunition and rocket-related divisions, driven by elevated demand for guided munitions.

Northrop’s role as a key supplier of solid rocket motors used in artillery and missile systems places it directly inside replenishment cycles associated with ongoing conflicts. These programs tend to be funded through multi-year appropriations, providing earnings visibility that markets typically reward during periods of geopolitical uncertainty.

RTX Corporation $RTX

RTX combines a large commercial aerospace footprint with one of the most significant defense portfolios in the market. That blend has proven valuable in the current environment. In the fourth quarter of 2024, RTX reported a fourteen percent increase in operating profit within its defense segment, driven by demand for missile systems and air defense technologies.

For the full year, RTX reported record revenue of approximately $80.7 billion, representing growth of roughly seventeen percent. The company ended the year with a total backlog of $218 billion, including approximately $93 billion tied to defense programs. Management has described the demand environment as unprecedented, reflecting the scale and persistence of global defense procurement.

From a financial standpoint, RTX’s backlog and cash flow profile position it to convert elevated defense budgets into earnings over an extended horizon, rather than through short-term order spikes.

General Dynamics $GD

General Dynamics offers diversified exposure across land systems, naval platforms, and aerospace, with defense-related businesses anchoring earnings during periods of elevated risk. In the second quarter of 2024, the company reported revenue of $11.98 billion, exceeding expectations, with defense sales accounting for a meaningful portion of the increase.

Profitability within the Combat Systems segment rose sharply, supported by demand for armored vehicles, artillery, and munitions. Management raised full-year revenue guidance, with notable increases across both Combat Systems and Marine Systems, including submarine programs tied to long-term naval procurement.

General Dynamics benefits from a contract structure that combines multi-year defense programs with recurring maintenance and support revenue. Historically, this mix has helped the stock hold up better than broader industrial peers during periods of geopolitical stress.

L3Harris Technologies $LHX

L3Harris represents a more modern layer of defense spending, focused on communications, sensors, and electronic systems. In response to rising global tensions, the company raised its 2024 revenue outlook to a range of $21.10 to $21.30 billion.

Quarterly performance has remained solid. In the third quarter of 2024, L3Harris reported revenue of $5.29 billion, up eight percent year over year, driven by demand for communications and mission-critical systems. The company ended 2024 with a record backlog of approximately $34 billion, reflecting strong order intake and a book-to-bill ratio above one.

As conflicts evolve, spending increasingly shifts toward coordination, intelligence, and secure communications. L3Harris sits directly in that spending path, with revenue streams that scale alongside complexity rather than hardware volume alone.

War does not create winners in equity markets. It accelerates capital toward businesses whose revenues become unavoidable. The companies outlined above share several defining characteristics: deep integration into government budgets, long-duration backlogs, and demand driven by replacement and readiness rather than discretionary choice.

For investors, the relevance of these stocks lies not in forecasting outcomes, but in understanding how risk reshapes cash flow certainty. When uncertainty rises, markets tend to reward visibility. Defense contractors, by design, sit at the intersection of spending priority and fiscal insulation.

That dynamic has repeated across cycles, and the current environment suggests it remains firmly in place.

—

Education, not investment advice.

Sources: