Your Sunday Market Brief

Opening Insight

Markets were in no mood for grace this week. Strong earnings, dovish Fed whispers, and a shutdown resolution weren’t enough to steady the ship. The mood? Volatile. Nvidia's blockbuster quarter was met with a shoulder shrug, and stocks whipsawed as traders rotated out of stretched names and tried to front-run policy pivots. Tech saw some of the sharpest reversals we've had all quarter. It wasn't about missing numbers — it was about what investors were no longer willing to blindly chase. Narratives cooled, and capital got cautious.

Market Recap

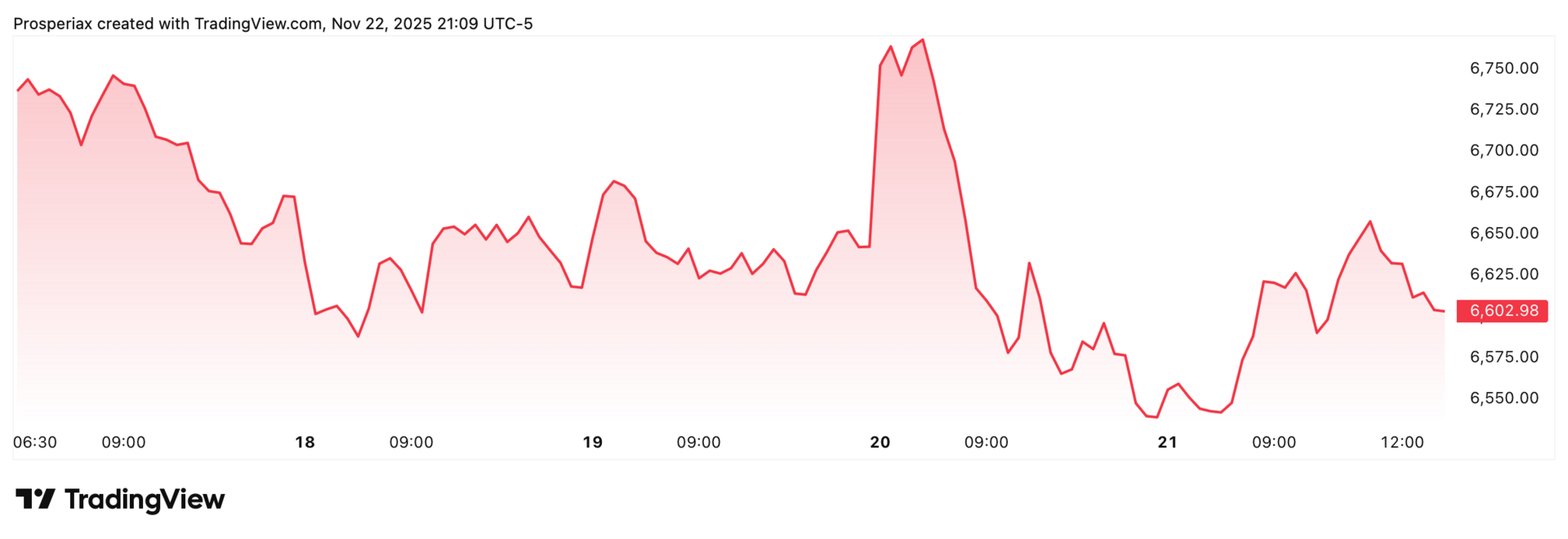

The S&P 500 dropped roughly 2% and the Nasdaq sank about 2.7%, as rising yields, macro jitters, and profit-taking drove a third straight weekly loss for tech-heavy benchmarks. Midweek saw a brief rally on Nvidia’s beat and Fed commentary, but that upside was erased Thursday before a relief bounce into Friday. Stocks wobbled on mixed economic data and sector rotation, while VIX notched its highest close since April.

The index posted a broad-based decline led by tech weakness and cautious positioning. Defensive names outperformed slightly as rate uncertainty weighed on cyclicals.

The Nasdaq tumbled for a third consecutive week, despite Nvidia’s strong report. AI enthusiasm faded as investors questioned valuations and rotated out of mega-cap winners.

Stocks That Won The Week

EA soared after reports it might be taken private in a record buyout. The Wall Street Journal noted potential acquirers (including Saudi Arabia’s PIF), which sent EA shares surging ~15% on the news, making it one of the week’s top S&P performers.

WALMART

Walmart raised full-year guidance and delivered a solid earnings report, positioning itself as a clear holiday season winner. The stock gained nearly 6% as investors leaned into staples.

REGENERON

Regeneron surged after the FDA approved its Eylea HD eye treatment. The stock was one of the top S&P 500 performers for the week, climbing nearly 9% as investors applauded the news.

Stocks That Lost The Week

HOME DEPOT

Shares dropped on a lowered profit forecast as housing-related demand weakened. Rising rates and margin pressure weighed on the outlook.

NVIDIA

Despite crushing earnings and guiding higher, Nvidia fell as traders locked in profits and questioned near-term upside after a heavy run-up.

VINFAST

The EV maker fell sharply after reporting larger-than-expected losses. High burn rates and global expansion costs rattled investors, putting pressure on the stock.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology | -6.1% | +23.1% |

Energy | +1.8% | +10.6% |

Financials | +1.2% | +11.4% |

Industrials | +0.7% | +15.2% |

Healthcare | +1.1% | +9.9% |

Tech declined sharply this week as valuation fatigue and profit-taking defined the tape. Despite strong earnings from names like Nvidia, traders rotated into safer territory. Energy led the sector board, rising nearly 2% on supply tensions, while Financials, Healthcare, and Industrials all posted modest gains. The rotation marked a clear move away from growth and into defensives as markets recalibrated.

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

Crypto Recap

Bitcoin dropped 1.5% this week, extending its decline as sentiment soured across risk assets. Ethereum lost 2.2%, while Solana and XRP saw steeper pullbacks. Altcoins continued to underperform despite ETF headlines, reflecting waning speculative appetite. Spot BTC ETFs saw light inflows, but weren’t enough to offset broader risk-off flows.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin (BTC) | –10.70% | –13% |

Ethereum (ETH) | –11.2% | –32% |

Solana (SOL) | –7.0% | –34% |

XRP | –10.26% | +1.17% |

Mover Of The Week

Ethereum

Ethereum was the week’s biggest mover, sliding 11% amid a broader shakeout across digital assets. The decline reflected a sharp pullback in risk appetite, with traders exiting altcoins faster than Bitcoin. Weak DeFi activity and continued outflows from ETH-linked products added pressure, making Ethereum the clear underperformer in an already-fragile crypto market.

Commodities Recap

Gold and silver saw muted gains as shifting Fed expectations kept real yields in check. Gold edged up 0.6% while silver climbed 1.2%. Oil added 0.7% on supply fears tied to Middle East tensions, and copper was marginally higher on steady industrial demand.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold | +0.6% | +13.9% | Fed caution boosted safe-haven demand. |

Oil (WTI) | +0.7% | +6.8% | Supply concerns offset weak demand. |

Copper | +0.2% | +2.7% | Chinese stimulus hopes kept prices firm. |

Silver | +1.2% | +9.3% | Tracked gold with industrial support. |

Macro Drivers

Markets were pulled in opposite directions as the return of federal economic data collided with shifting rate expectations. The delayed payrolls report showed 119,000 jobs added vs. ~50,000 expected, pushing Treasury yields higher early in the week and reducing the probability of a December rate cut. Fed minutes from the October meeting reinforced that policymakers were still divided, which added to uncertainty. But by Friday, comments from New York Fed President John Williams, who suggested cuts were still possible, pushed rate-cut odds back above 70% and helped spark a late rebound in equities.

At the same time, earnings continued to outpace expectations — 83% of S&P 500 companies beat estimates — but valuation pressure muted the upside. Nvidia’s strong quarter failed to lift tech as profit-taking hit the most crowded trades in the market. The sudden restart of government data releases after the shutdown forced investors to digest labor data, inflation commentary, and consumer trends all at once, driving the VIX to its highest close since April. With stretched valuations, mixed policy signals, and a flood of new data, money rotated defensively even as earnings remained solid.

Get home insurance that protects what you need

Standard home insurance doesn’t cover everything—floods, earthquakes, or coverage for valuable items like jewelry and art often require separate policies or endorsements. Switching over to a more customizable policy ensures you’re paying for what you really need. Use Money’s home insurance tool to find the right coverage for you.

Final Take

This was one of those weeks where the setup looked supportive, but the market simply wasn’t ready to run. Nvidia delivered exactly what investors asked for — and the reaction still faded. Fresh economic data finally returned after the shutdown, but instead of clarity, it added another layer of tension. Payrolls came in hotter, Fed messaging split again, and rate-cut odds swung back and forth almost daily. That uncertainty fed directly into positioning, and the most crowded trades — especially in tech — took the brunt of it.

The broader takeaway is that markets aren’t rejecting growth; they’re rejecting confidence. Earnings remain strong, but the bar has moved higher and investors are more willing to take gains than chase upside. Crypto reflected the same mood, with both Bitcoin and Ethereum absorbing double-digit weekly losses. Defensive rotation isn’t a sign of panic — it’s a sign of recalibration. As we head into a shortened holiday week, sentiment looks cautious but stable, and conviction will come from data, not narratives.

If you find value in these weekly recaps, consider subscribing to Prosperiax Gold for deeper analysis and tools to stay ahead of the market.