Your Sunday Market Brief

Opening Insight

Good Morning Ladies,

Markets moved like a slingshot this week — tense early, then suddenly snapping higher. Trade worries, bank jitters, and sector churn made the week feel heavier than the final numbers suggest. The S&P ended up 1.7%, the Nasdaq +2.1%. What flipped the tone? Bank earnings came in solid, Trump backed off tariff threats, and AI names regained footing. And while investors leaned into the rally, they did it with one hand near the exit — note the flight to gold, the drop in Treasury yields, and the dip in oil. As seen in the Commodities Recap, that rotation tells you where nerves still linger.

Personally, I think this week showed a deeper pattern: volatility is now opportunity, not panic. You had quality names rally on good news (see the Market Recap), safety trades get bid up when headlines hit (see Macro Drivers), and even Ethereum decouple from the broader crypto drop (see Crypto Recap). In short, markets are jittery but not broken — and that’s an environment where decisive capital moves are starting to separate winners from noise.

Market Recap

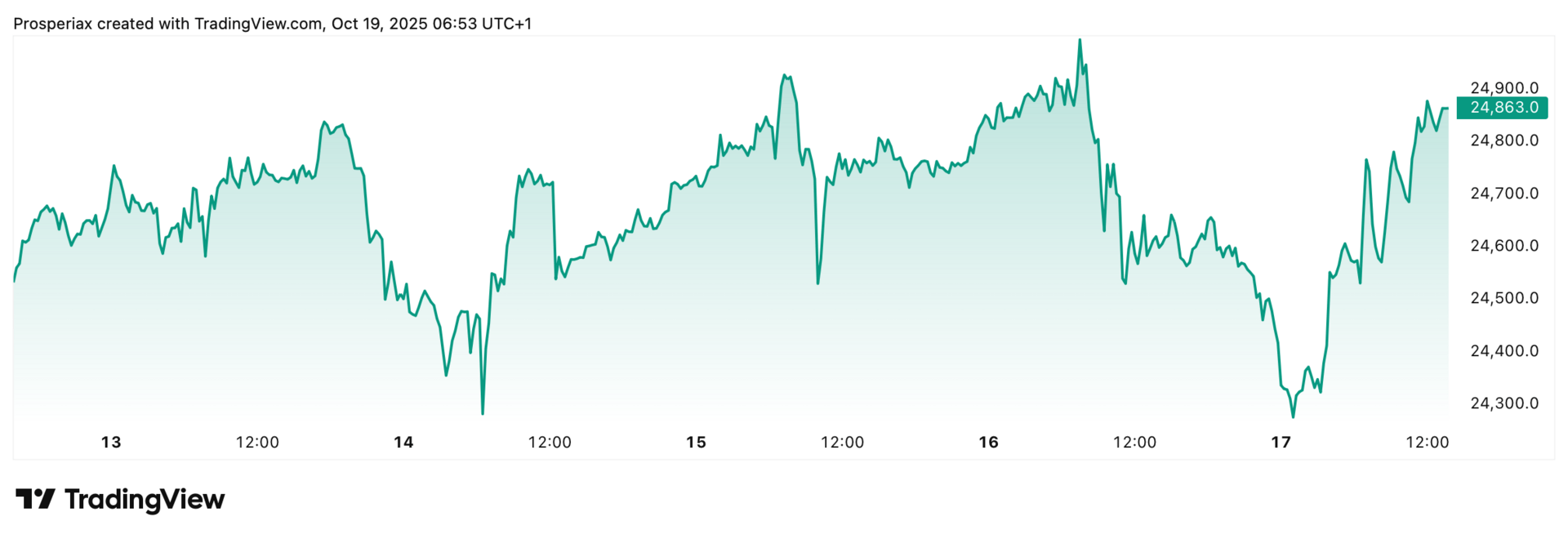

Markets chopped around but closed the week higher, with the S&P 500 up about 1.7% and the Nasdaq gaining 2.1%. Early losses tied to U.S.–China trade tensions and bank worries faded midweek as earnings from Morgan Stanley and Bank of America beat expectations. Tech stocks regained steam with AI optimism lifting names like Micron and Nvidia. By Friday, Trump’s softened rhetoric on tariffs flipped futures positive. Underneath it all: a flight to safety — the 10-year Treasury yield dropped to 3.97% and gold briefly broke records — but investors leaned into the rally as risks calmed.

The S&P 500 climbed around 1.7% this week. Markets opened with anxiety over bank credit concerns and U.S.-China trade tensions. But midweek strength in bank earnings—like Morgan Stanley and Bank of America—and optimism around tech stocks helped shift momentum. Trump later walked back tariff threats, easing fears and boosting futures into Friday. Investors shook off the noise and rotated back into quality.

The Nasdaq led all indexes, gaining roughly 2.1%. Semiconductor and software names bounced back after early losses. Micron jumped over 5% on analyst upgrades, while chip optimism supported broader tech. Oracle dragged on Friday, but overall strength in AI-linked names helped the Nasdaq outperform.

Stocks That Won The Week

AMD signed a multi-year AI chip deal with OpenAI. The revenue potential—"tens of billions"—drove heavy interest. Shares surged Monday and held strong all week on the news.

Higher crude and record refining margins boosted Exxon. Its early October guidance flagged strong Q3 results, and rising oil this week reinforced the bullish setup.

Boeing delivered 55 planes in September—its best showing since 2018. Big new orders and a softening trade stance from Trump lifted sentiment.

Stocks That Lost The Week

A U.K. lawsuit claimed its baby powder causes cancer. The legal headline alone erased a week’s worth of gains and made Kenvue the week’s worst S&P 500 performer.

HPE issued 2026 guidance well below forecasts. The unexpected miss drove selling as investors repriced the outlook.

Credit worries flared again after Zions flagged big loan losses. Regional bank stress pulled down FITB despite no direct headlines.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology | −4.1% | +19.8% |

Energy | −2.9% | +1.2% |

Financials | −2.8% | +8.4% |

Industrials | −2.2% | +13.9% |

Healthcare | −1.5% | +5.2% |

Every major sector posted a loss this week. Technology fell hardest, dragged by Oracle’s miss and broad profit-taking. Energy and Financials also slipped as oil softened and regional bank fears resurfaced. Industrials gave up ground despite a strong showing from JB Hunt. Each sector struggled with a mix of earnings, demand concerns, and rotation.

Email Was Only the Beginning

Four years in the making. One event that will change everything.

On November 13, beehiiv is redefining what it means to create online with their first-ever virtual Winter Release Event.

This isn’t just an update or a new feature. It’s a revolution in how content is built, shared, and owned. You don’t want to miss this.

Crypto Recap

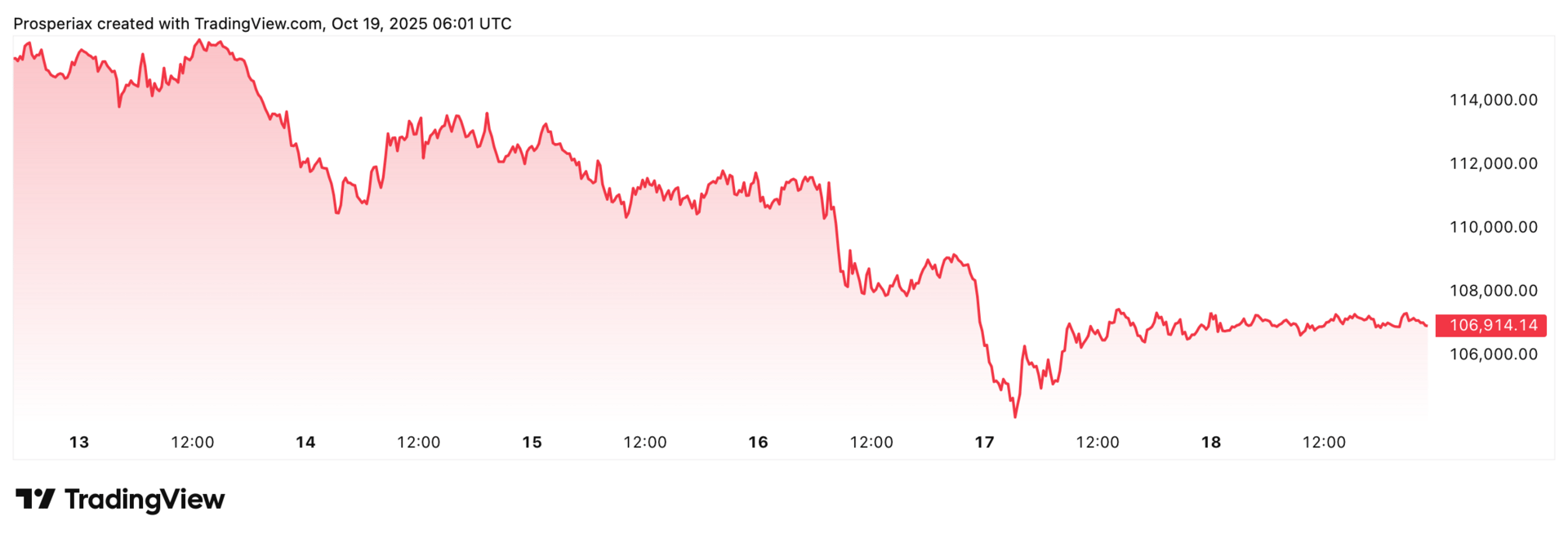

Crypto snapped its rally this week, shedding over $230 billion in value in one day. Bitcoin fell roughly 4% as risk appetite faded, retreating from $112K to $108K. Liquidations spiked, the Fear & Greed Index plunged, and traders moved to the sidelines. Ethereum stood out with a +3.6% gain, bucking the trend on ETF hopes and bullish technicals. Overall, sentiment shifted from euphoria to caution as regulatory noise and geopolitical headlines crept back into view.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin (BTC) | +2.1% | +34% |

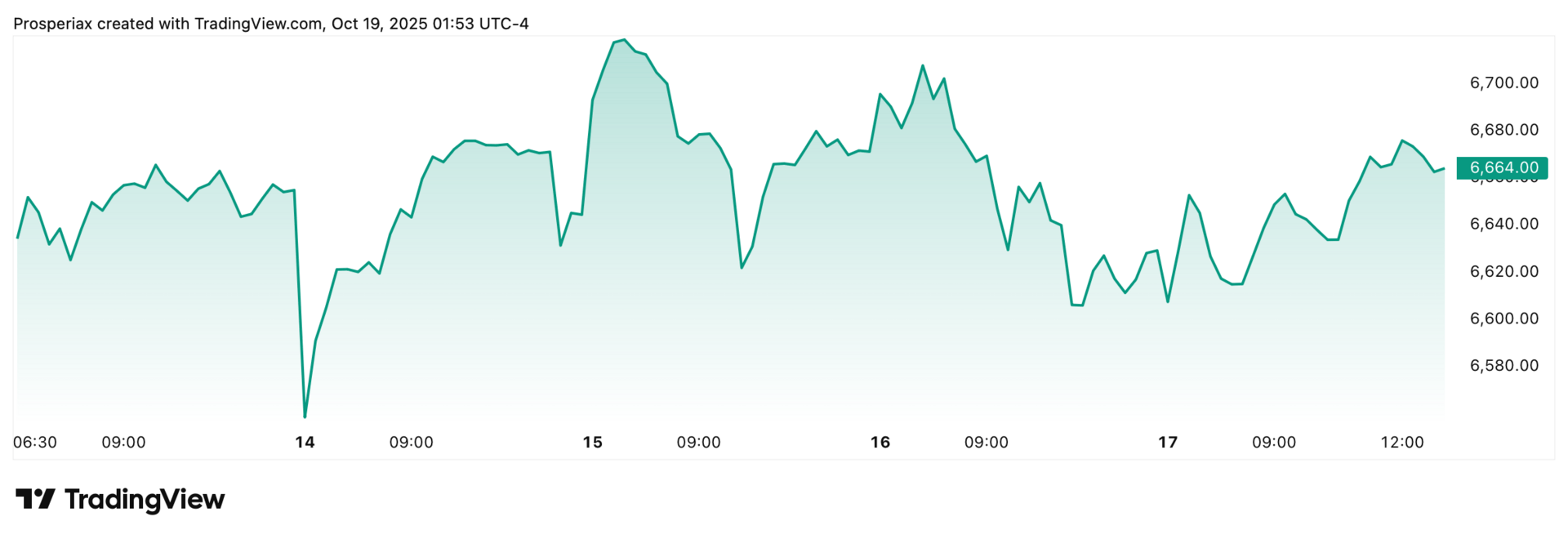

Ethereum (ETH) | +3.6% | +47.15% |

Solana (SOL) | +1.8% | +20.95% |

XRP | +0.9% | +18–20% |

Mover Of The Week

Ethereum rose 3.6%, bucking the trend. Traders pointed to strong technicals and ETF inflow speculation. While BTC dropped, ETH held above support levels. Analysts noted improved stability and renewed confidence in the Ethereum ecosystem.

Commodities Recap

Precious metals caught a bid while industrial commodities slipped. Gold rose 1.2% and silver 0.7% as markets looked for safety amid equity jitters and a falling 10-year yield. Oil dropped nearly 2% after the IEA warned of a supply glut and slowing global demand. Copper dipped too, reflecting weak factory activity and China growth concerns. In short, investors moved into haven trades while backing off cyclical exposure.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold | +1.2% | +17.3% | Safe-haven demand rose after equity sell-off. |

Oil (WTI) | −1.9% | +7.1% | Pressured by new oversupply and global slowdown fears |

Copper | −0.4% | +11.8% | Slight dip from industrial demand concerns. |

Silver | +0.7% | +13.4% | Tracked gold higher with smaller magnitude. |

Macro Drivers

Commodities were driven by macro crosswinds. Gold rallied as Treasury yields fell and risk-off sentiment took hold — making haven assets attractive. At the same time, the U.S. dollar strengthened, pressuring oil and copper. Crude markets slumped on IEA warnings of a surplus and weakening demand, while safe-haven buying dominated metals. Economic slowdown fears, dollar strength, and volatility all converged to shape this week’s mixed commodity landscape.

Final Take

This week’s data paints a market trying to balance caution with conviction. Investors snapped up banks and Boeing on earnings, bid up gold as yields fell, and punished anything with weak guidance (Oracle, HPE, KVUE). But context matters: the biggest tech pullbacks came after huge year-to-date runs, and the biggest commodity moves followed macro shifts — not internal weakness. As you’ll see in the Sector Snapshot and Commodities Recap, this wasn’t a panic — it was a rotation.

When I look at where money’s flowing, a few things stand out. Ethereum holding firm while Bitcoin slipped is one signal. Silver quietly tracking gold higher — just +0.7% this week, but with gold near ATHs — is another. Historically, silver lags behind gold’s breakout, and that could make it worth watching now. Financials and industrials also showed resilience despite macro noise, suggesting investors are still looking for exposure to the “real economy,” not just defensives.

Looking forward, I’d keep an eye on quality tech re-entry points, potential silver momentum, and any renewed bid in cyclicals if oil finds support. There’s no shortage of headlines — shutdown risks, China, rates — but markets seem to be treating volatility as a shopping list, not a fire alarm. That’s a subtle but important shift. It tells me capital isn’t fleeing — it’s just getting smarter about where to go.

If you found this helpful, Prosperiax Gold goes one level deeper. I break down specific plays, positioning shifts, and how smart money is reading the tape — every Wednesday. Tap below to upgrade.