Your Sunday Market Brief

Opening Insight

Good Morning ladies,

What a week. The market delivered a flood of signals—Fed decisions, earnings fireworks, a China trade breakthrough—and investors responded by bidding risk back up. The S&P topped 6,800 and the VIX sank, but don’t mistake it for calm. Powell's tone wasn’t exactly dovish, the trade deal has cracks, and tech's cost structures are under the microscope. And yet, money flowed back into megacap names, AI-levered semis, and crypto. It’s rotation, not euphoria.

Personally, I think this week made one thing clear: capital is choosing clarity. Amazon gave it (11% jump), Meta didn't (8% drop). Same with commodities: copper soared on China optimism, oil dipped on supply tension. In crypto, Ethereum tracked steady while Solana pulled back. This market isn’t chasing headlines—it’s rewarding control. That matters.

Market Recap

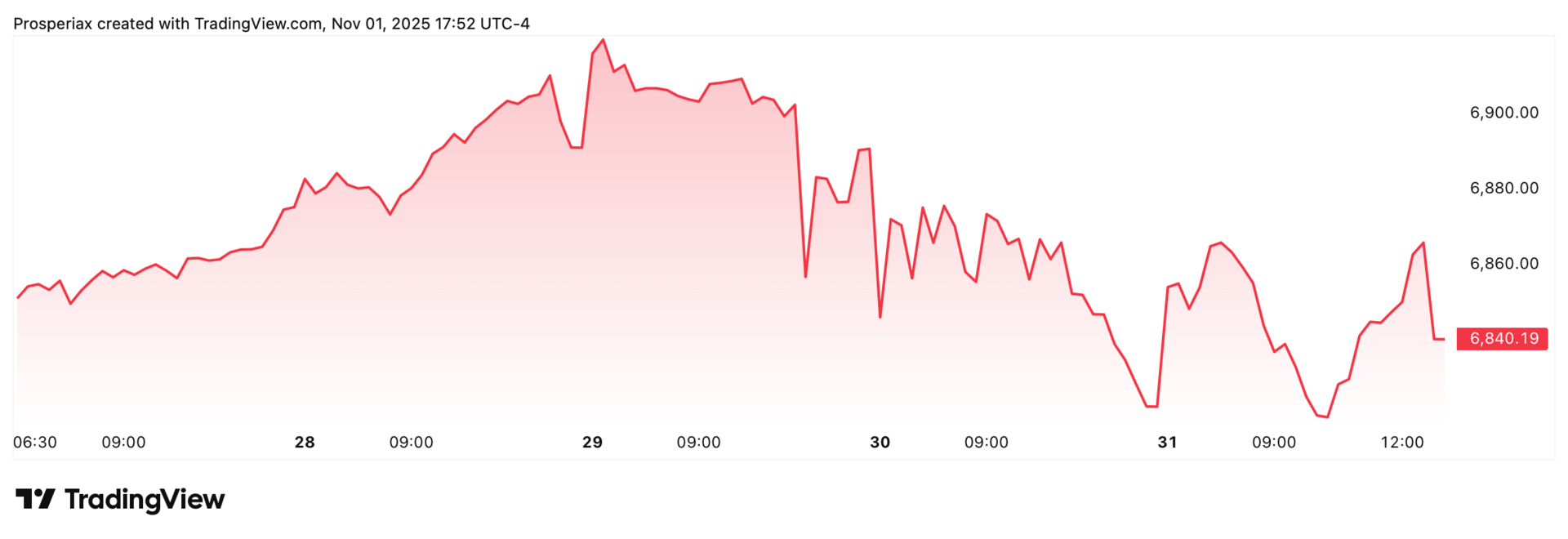

Markets rallied early in the week with the S&P 500 closing above 6,800 and the Nasdaq gaining nearly 2% on Monday. Tech and communication services led the charge, with semiconductors jumping ~2.7% on strong AI momentum. Optimism around U.S.-China trade talks and better-than-expected earnings from giants like Amazon and Google pushed sentiment higher. The VIX dropped to a one-month low.

Midweek brought the Fed. The widely-expected 25 bp rate cut landed Wednesday, pulling the target rate to 3.75–4.00%. But Powell’s tone was careful, saying December’s cut is “not a foregone conclusion.” That, paired with stronger-than-expected jobless claims, cooled rate-cut hopes. Still, over 80% of S&P companies had beaten earnings estimates, which helped cushion any downside. The week closed on a cautiously bullish note.

The S&P 500 surged roughly 1.7% this week, buoyed by megacap tech earnings beats and the partial U.S.–China trade deal. The index led early in the week, climbing above 6,800, as Amazon and Google delivered strong results and investors digested a less-dovish-than-expected Fed cut. As the week closed, the S&P held on despite Treasury yields inching higher on stronger labour data.

The Nasdaq 100 outpaced the broader market with a ~2.1% gain, driven by heavyweights in AI and cloud computing. Stocks like Nvidia and Microsoft powered the advance after data-centre spending and AI-chip deal news hit. The index rallied mid-week on tech strength, and the pull-back from the Fed’s cautious tone was muted given the strong earnings backdrop.

Stocks That Won The Week

Nvidia climbed after crossing a $5 trillion market cap. AI chip demand and new government contracts pushed shares to new highs.

Tesla jumped on U.S.-China trade optimism. Reduced tariff pressure boosted sentiment for China-exposed EV makers.

Amazon soared after Q3 results blew past expectations. Cloud (AWS) rebounded with 20% growth, and the company guided higher across retail and advertising.

Stocks That Lost The Week

Chipotle dropped after trimming its sales outlook despite a strong earnings beat. Consumer softness and tariff pressures weighed.

Meta fell hard post-earnings as investors balked at surging AI-related spending and a surprise tax hit.

Critical Metals sank on easing trade tensions. A thaw in U.S.-China relations removed rare-earth supply fears.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology | +1.7% | +24.8% |

Energy | +0.1% | –2.0% |

Financials | +0.6% | +12.9% |

Industrials | +1.1% | +10.7% |

Healthcare | +0.7% | +8.0% |

Tech outperformed again as megacap names led post-earnings. Industrials rose with strong showings from names like Caterpillar. Energy and Financials posted modest gains, supported by rising demand signals and stable yields. The only underperformers were defensive sectors, which saw rotation out as risk appetite returned.

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Crypto Recap

Crypto had a mixed week. Bitcoin slipped about 1.3% as traders took profits after its October surge and ETF inflows slowed. The softer macro backdrop and cautious Fed tone kept volatility contained, but risk appetite shifted toward assets with clearer catalysts. Ethereum stood out—rising 2.2% as ETF optimism and steady network growth attracted fresh inflows. Solana eased 1.1% after a multi-week rally, while XRP added 0.6% on light volume. Overall, crypto markets consolidated after recent gains, trading more on positioning than on panic or hype.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin (BTC) | -1.3% | +72% |

Ethereum (ETH) | +2.2% | +54% |

Solana (SOL) | –1.1% | +10% |

XRP | +0.6% | +38% |

Mover Of The Week

Ethereum quietly led the market this week. The combination of continued ETF optimism, consistent developer activity, and relative stability versus Bitcoin made it the preferred crypto trade. Institutional inflows into ETH-linked products picked up, and price action showed resilience despite rotation elsewhere. For investors tracking long-term adoption, Ethereum’s ability to hold strength while Bitcoin cooled was a subtle but meaningful signal of confidence returning to quality assets.

Commodities Recap

Commodities split sharply this week as investors weighed safe-haven demand against shifting supply dynamics. Gold climbed 1.2%, continuing its steady march higher as Treasury yields dipped post-Fed and investors rotated into havens. The yellow metal briefly tested record levels above $4,000 an ounce, driven by central bank buying and uncertainty around U.S.–China trade implementation. Silver followed suit (+0.7%), supported by investment inflows and its typical correlation with gold, though industrial demand remained uneven.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold | +1.2% | +18.2% | Fed caution boosted safe-haven demand. |

Oil (WTI) | +0.7% | –2.0% | Supply concerns offset weak demand. |

Copper | +0.4% | +11.5% | Chinese stimulus hopes kept prices firm. |

Silver | +0.7% | +14.0% | Tracked gold with industrial support. |

Macro Drivers

The Fed delivered a rate cut, but Powell's caution cooled hopes for more. Treasury yields ticked higher post-meeting, and jobless claims fell, reinforcing a strong labor market. Meanwhile, the U.S. and China announced a partial trade agreement—halving tariffs, resuming commodity imports, and easing biotech and rare-earth restrictions. Markets reacted modestly, with rare-earth stocks dropping sharply. Elsewhere, Argentina elected a pro-market president, adding to a broader "risk-on" shift.

Pet insurance can help your dog (and your wallet)

Did you know 1 in 3 pets will need emergency treatment this year? Pet insurance helps cover those unexpected vet bills, so you can focus on care—not cost. View Money’s list of the Best Pet Insurance plans and protect your furry family member today.

Final Take

A week like this separates noise from signal. The Fed cut rates, but the market’s read wasn’t dovish. Powell kept the door open—but didn’t swing it wide. Meanwhile, the U.S.-China trade deal gave bulls just enough to justify optimism without overcommitting. That subtlety showed in sector moves: tech surged, but mostly where earnings clarity emerged (Amazon, Google). Commodities split—gold rose on caution, copper on confidence. Even Bitcoin felt smarter this week.

From my view, the winners weren’t the most hyped—they were the most decisive. Amazon’s clean outlook, Nvidia’s execution, Tesla’s geopolitical tailwind. On the other side: companies that stumbled in messaging or visibility got punished (Meta, Chipotle, CRML). The pattern is forming: markets aren’t rejecting risk—they’re pricing discipline.

Looking forward, I’d watch tech follow-through, copper supply signals, and whether Powell’s December ambiguity turns into policy movement. It’s a trader’s market, not a passenger’s one.

If you found this helpful, Prosperiax Gold goes one level deeper. I break down specific plays, positioning shifts, and how smart money is reading the tape—every Wednesday. Tap below to upgrade.