Your Sunday Market Brief

Opening Insight

Good Morning ladies,

Big tech didn’t lead this week — and that might be the most telling part of the rally. While names like GM and ISRG did the heavy lifting, the market’s tone shifted from defensive to cautiously opportunistic. Healthcare stumbles, auto surprises, and selective rotation into financials and industrials gave this bounce some teeth. But sentiment is still fractured.

The bigger forces? A Fed that won’t blink, a bond market still crowding everything else, and just enough geopolitical easing to pull oil back from its highs. Risk came off the mat, but not because of a macro breakthrough — it was earnings that bought time. See the Commodities Recap and Macro Drivers for what’s still lurking underneath.

Market Recap

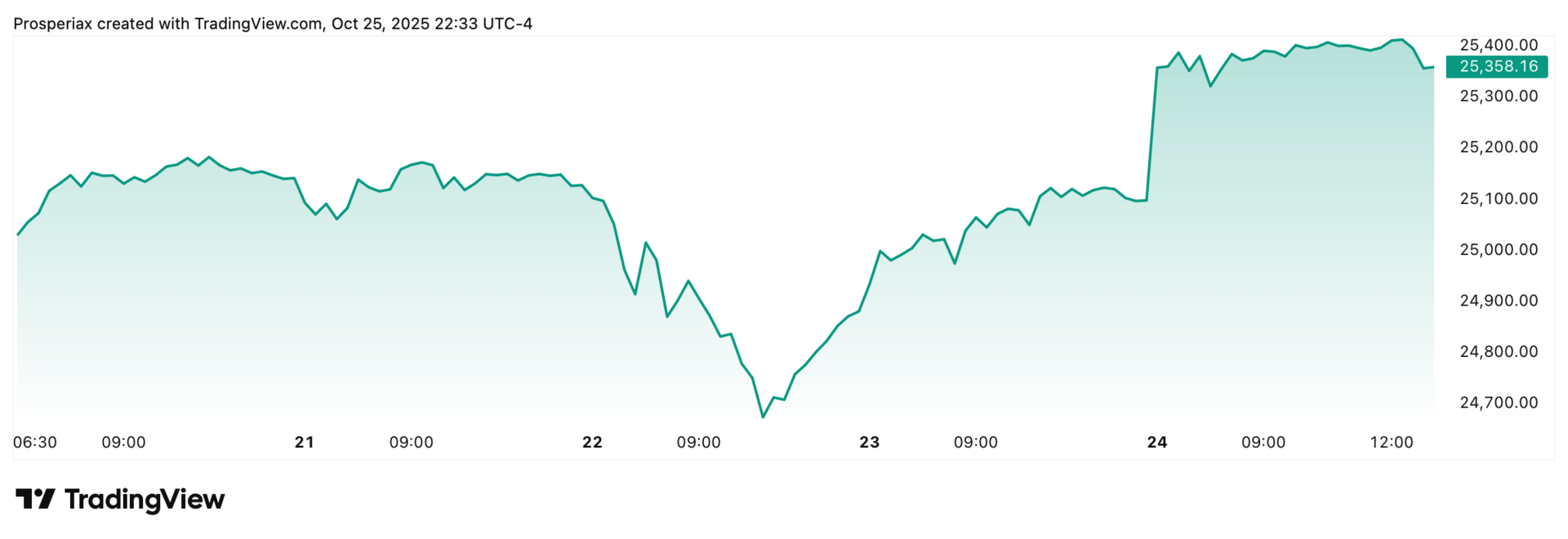

It was a rebound week across U.S. equities, led by strong earnings from blue-chip names and big upside in tech and automakers. The S&P 500 climbed back from last week’s slide as General Motors (+14.9%) and Intuitive Surgical (+13.9%) posted major gains on upbeat forecasts. The Nasdaq found footing despite Netflix’s (-10.1%) sharp drop, while the Dow outperformed thanks to strength in financials and industrials. Broad risk sentiment improved — but not enough to lift oil, copper, or Bitcoin, all of which ended lower.

The S&P 500 snapped a three-week losing streak, lifted by solid earnings from names like GM and ISRG. Gains were broad across sectors, with financials and industrials helping push the index higher.

The Nasdaq recovered modestly, paced by tech strength despite a 10% drop in Netflix. Chipmakers and software firms provided support as bond yields eased slightly midweek.

Stocks That Won The Week

General Motors rallied after a strong earnings beat and an optimistic full-year forecast. Its focus on cost controls and resilience despite tariff pressures reassured investors.

ISRG surged after crushing earnings expectations and raising its guidance. Strong adoption of its da Vinci robotic systems drove the bullish outlook.

Ford posted better-than-expected earnings, which outweighed a slight guidance cut tied to a one-off supplier fire. Investors focused on resilient demand and cost management.

Stocks That Lost The Week

MOH collapsed after slashing its earnings forecast due to rising costs in ACA plans. This was its third cut this year, raising red flags around healthcare margins.

DECK tumbled on weak guidance despite solid earnings. Management flagged consumer slowdown risks and pricing pressure from tariffs.

Netflix slipped after a surprise $600M+ tax hit in Brazil dragged profits below expectations. The one-off charge rattled investors despite otherwise stable performance.

Sector Snapshot

Sector | Weekly Change | YTD Change |

|---|---|---|

Technology | +2.2% | +23.6% |

Energy | +0.9% | +3.0% |

Financials | 1.8% | +13.1% |

Industrials | +1.3% | +10.0% |

Healthcare | +1.0% | +8.2% |

The sector snapshot this week painted a mixed picture.Tech rebounded on software and semiconductor strength, while healthcare dragged due to Molina’s collapse. Industrials and consumer discretionary caught tailwinds from auto earnings. Utilities and staples held steady, reflecting some caution beneath the surface. Healthcare underperformed sharply due to rising cost concerns, led by Molina’s 20% drop. Utilities and staples held steady, signaling some investor caution beneath the surface. Overall, sector moves reflected a shift toward value and earnings-driven momentum.

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Crypto Recap

Crypto markets held their ground this week despite rising Treasury yields and global risk jitters. Bitcoin hovered near $34,000 after spiking mid-week, while Ethereum followed a similar path just above $1,800. Optimism around a potential Bitcoin ETF approval helped offset broader macro pressures.

Performance Overview

Asset | Weekly Change | YTD Change |

|---|---|---|

Bitcoin (BTC) | –3.1% | +67.6% |

Ethereum (ETH) | +3.3% | +52.6% |

Solana (SOL) | –1.8% | +9.1% |

XRP | +2.1% | +37.5% |

Mover Of The Week

Ethereum led the crypto market this week, gaining momentum on the back of rising institutional interest and key ecosystem developments. ETH briefly surged past $1,850 after reports surfaced that major asset managers had met with the SEC to discuss Ethereum ETF filings. This fueled speculation that ETH could follow Bitcoin’s regulatory path toward spot ETF approval. The rally was further supported by increased staking activity and positive sentiment around Ethereum’s long-term role in DeFi infrastructure.

Commodities Recap

Commodities offered a split narrative this week. Crude oil retreated as geopolitical fears around the Israel-Hamas conflict cooled, with diplomatic engagement tamping down concerns over a wider regional spillover. Brent and WTI both logged their first weekly declines in a month, signaling temporary relief in the energy complex. Meanwhile, gold inched higher despite softer demand signals, as some investors rotated defensively amid growing anxiety around Fed policy uncertainty and U.S. fiscal sustainability. The dollar’s strength capped further upside, but the metal still posted a gain, preserving its safe-haven narrative for now.

Asset | Weekly Change | YTD Change | Context |

|---|---|---|---|

Gold | +0.9% | +16.7% | Rose on Fed uncertainty and safe-haven flows. |

Oil (WTI) | –0.4% | +3.0% | Dropped on easing tensions and weaker global demand signals. |

Copper | +0.3% | +11.2% | Rose slightly despite weak China data and muted demand outlook |

Silver | +0.6% | +13.8% | Inched up as Fed uncertainty offset weak industrial appetite |

Macro Drivers

Yields stayed elevated and the dollar remained strong, continuing to pressure risk assets and suppress commodity demand. While bond markets saw minor pullbacks, the 10-year Treasury yield held near multi-year highs, reinforcing tight financial conditions. Hawkish Fed rhetoric and lingering inflation stickiness left rate cut hopes stalled, keeping markets on edge.

This backdrop weighed heavily on industrial commodities like copper and silver, while crude slipped on softening demand expectations from China and Europe. In contrast, gold saw renewed strength, with investors hedging against macro instability and looking ahead to potential policy pivots. Natural gas surged on early cold-weather signals and tighter-than-expected storage, showing that seasonality still matters even in a macro-driven tape.

Final Take

Earnings gave equities room to breathe — but there’s no clear path forward. Bond yields are still biting, the dollar isn’t backing off, and oil’s retreat says more about fragile demand than macro calm. The winners this week weren’t speculative growth or safe havens — they were companies with pricing power, cost discipline, and clean execution.

Crypto mostly held its ground, with Ethereum flashing signs of institutional interest just as ETF rumors flared up again. But without regulatory clarity or real inflows, it’s still a headline-driven trade. Commodities, meanwhile, are caught in a tug-of-war between seasonal patterns and stubborn macro weight.

As we head into another packed earnings slate and watch for cracks in consumer resilience, remember: this tape is being shaped in real time by positioning, not just data. There’s a reason utilities and gold didn’t flinch — not everyone’s convinced the worst is behind us.

If you find value in these weekly recaps, consider subscribing to Prosperiax Gold for deeper analysis and tools to stay ahead of the market.