ETFs have become one of the clearest ways to read the market’s pulse.

Instead of chasing individual stocks, investors are using them to understand where money is flowing, what sectors are leading, and how global narratives are shifting.

This market isn’t moving in one direction — it’s rotating. Growth, defense, and innovation are all trading places. The following five ETFs reveal how that rotation is taking shape.

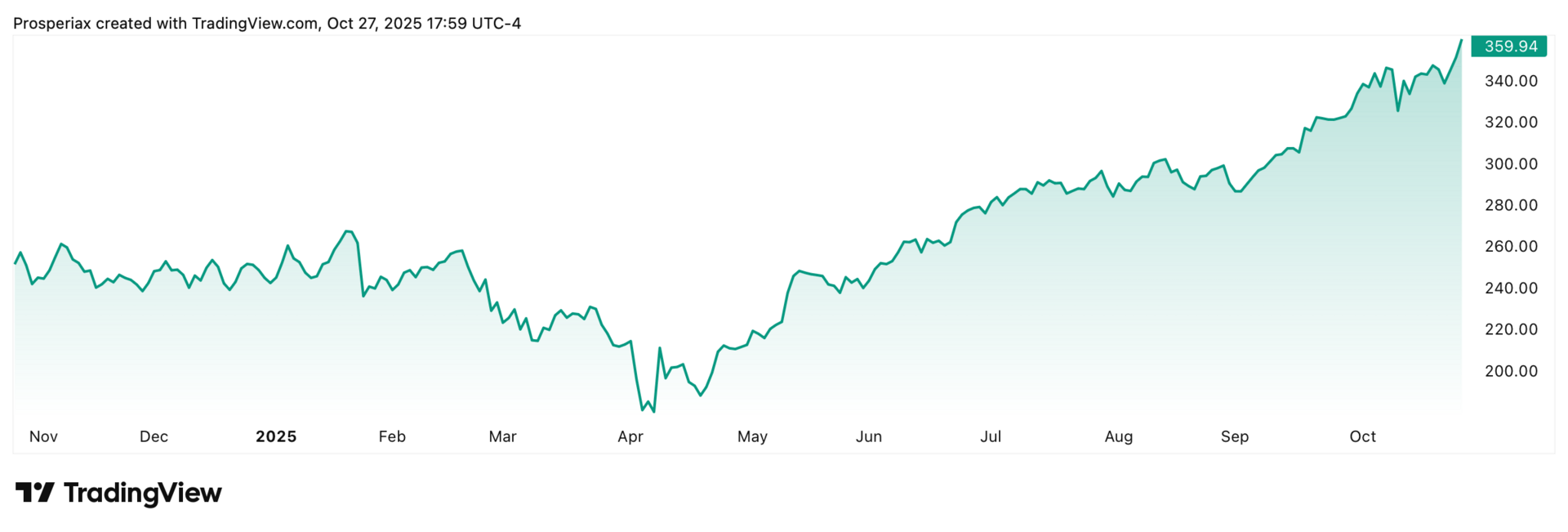

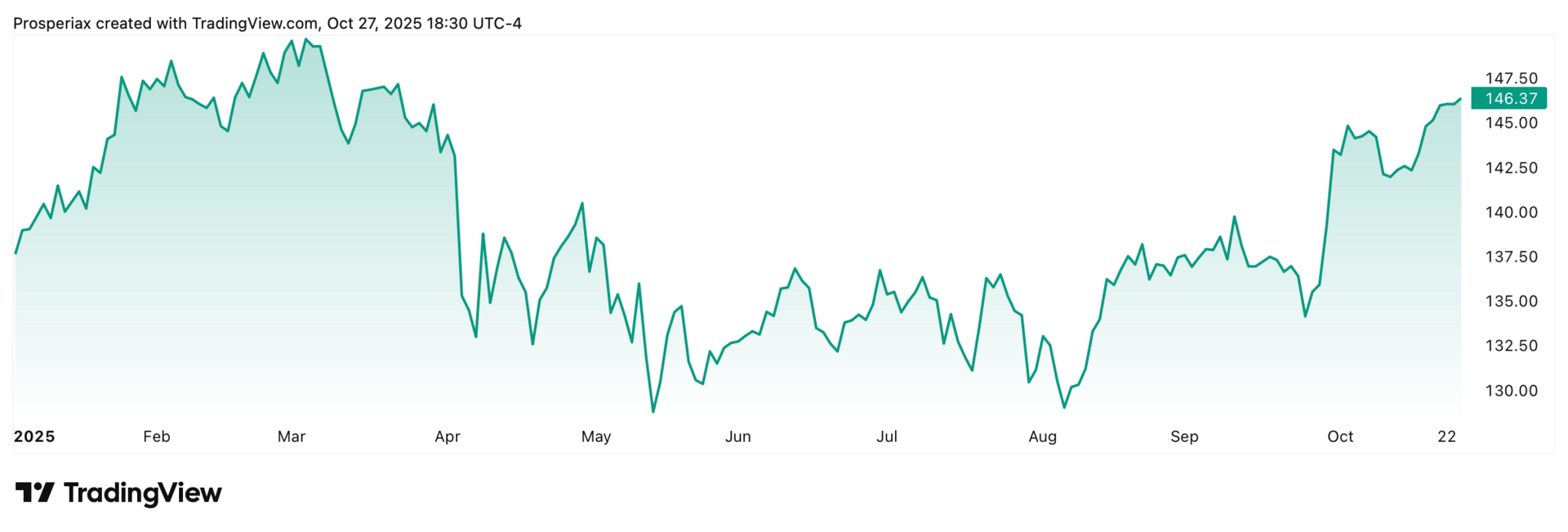

SMH — VanEck Semiconductor ETF

SMH tracks global chipmakers powering AI and advanced computing. Semiconductors are the backbone of nearly every modern industry — from cloud infrastructure to electric vehicles — and their demand is accelerating as the AI build-out expands worldwide.

What makes SMH especially relevant now is how it reflects the intersection of growth and geopolitics. The United States continues to strengthen domestic chip production, while tensions with China keep supply chains in focus. This dynamic keeps volatility elevated but opportunity intact.

Investors watch SMH not only for its exposure to NVIDIA, Taiwan Semiconductor, and Broadcom — but for what it says about the health of innovation itself. When semiconductors lead, markets tend to follow.

Pet insurance can help your dog (and your wallet)

Did you know 1 in 3 pets will need emergency treatment this year? Pet insurance helps cover those unexpected vet bills, so you can focus on care—not cost. View Money’s list of the Best Pet Insurance plans and protect your furry family member today.

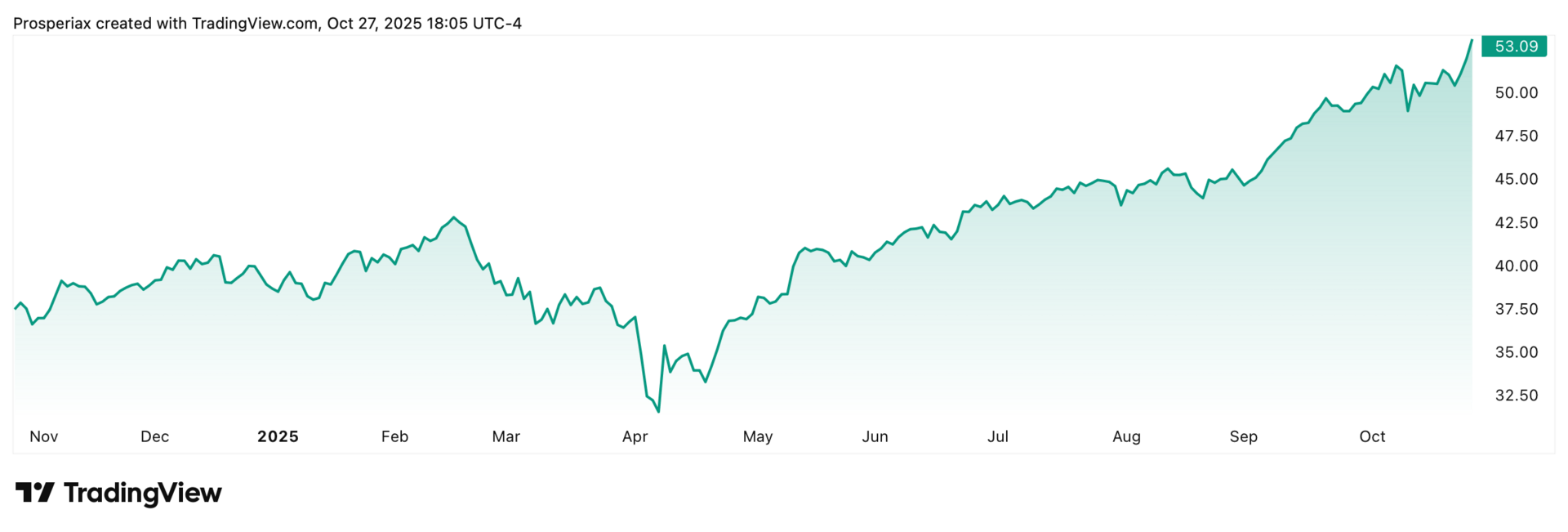

AIQ — Global X Artificial Intelligence & Technology ETF

AIQ focuses on companies developing or using artificial intelligence across software, chips, and cloud infrastructure. If SMH is the hardware backbone, AIQ captures the broader software and adoption side of the story.

AI is no longer just a headline — it’s becoming a structural growth theme. Enterprise integration, automation, and data-driven efficiency are rewriting cost structures across industries. This ETF benefits from that multi-sector reach, with major holdings including NVIDIA, Alphabet, and Microsoft.

The key insight: AIQ represents the bridge between today’s productivity cycle and tomorrow’s innovation curve. As capital flows toward scalable efficiency, AIQ remains one of the clearest ways to track that trend.

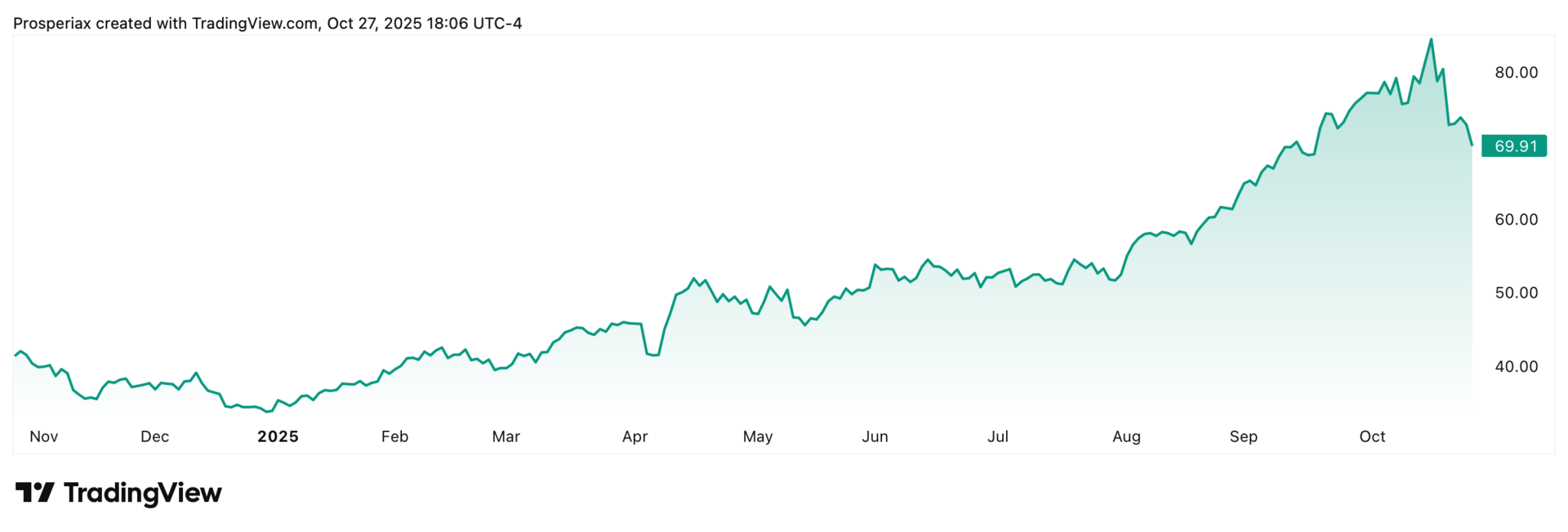

GDX — VanEck Gold Miners ETF

GDX tracks global gold-mining firms benefiting from rising metal prices and inflation hedges. While growth sectors dominate the narrative, gold quietly reflects the other side of market psychology — protection and preservation.

Gold miners often move with leverage to the metal itself. When uncertainty grows or rates ease, their margins expand quickly. With central banks maintaining elevated gold reserves and investors seeking stability amid currency volatility, GDX becomes a strategic signal.

This ETF isn’t just about gold — it’s about confidence. Watching how GDX behaves relative to the broader market can reveal when capital is shifting from offense to defense.

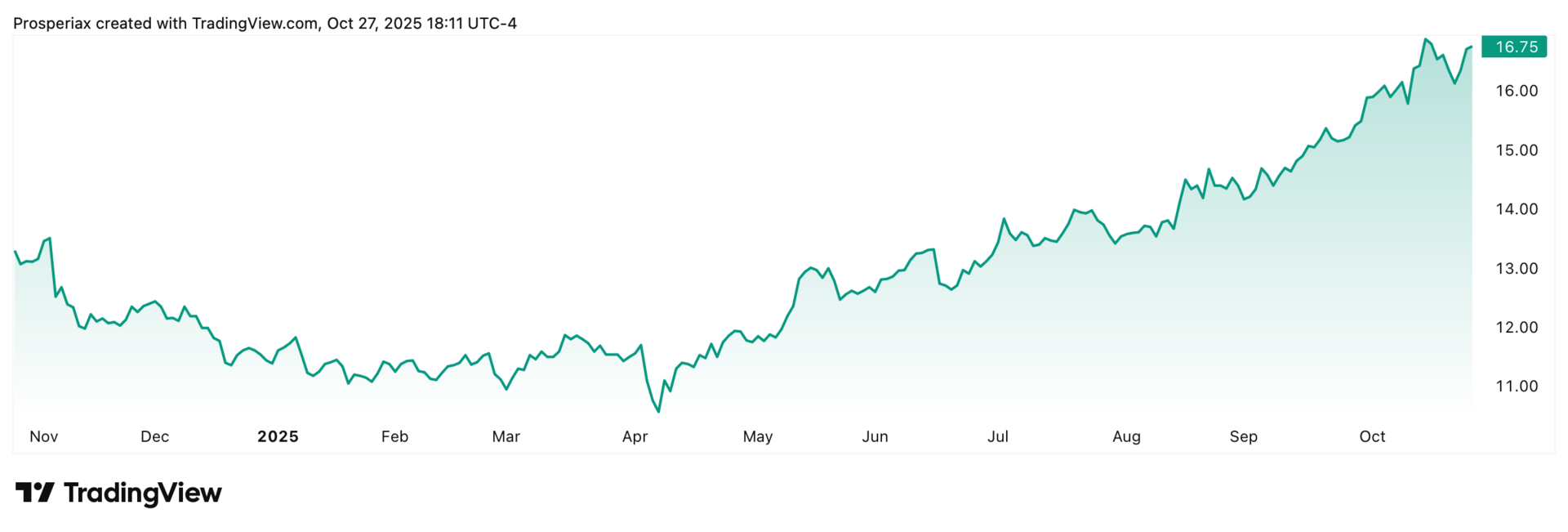

ICLN covers renewable-energy leaders in solar, wind, and battery storage. After years of overvaluation and rate-sensitive weakness, the sector has reset — and now sits at the intersection of policy, innovation, and long-term infrastructure growth.

The clean-energy transition isn’t a short-term story. It’s a multi-decade capital cycle that will shape manufacturing, transportation, and global power grids. With holdings like Enphase, SolarEdge, and First Solar, ICLN reflects the new phase of this evolution: disciplined growth after exuberance.

It’s an ETF that rewards patience — one that mirrors the broader shift toward sustainability as a structural, not speculative, trend.

XLV — Health Care Select Sector SPDR Fund

XLV represents large-cap healthcare names leading medical innovation and stability. While technology drives excitement, healthcare provides endurance. UnitedHealth, Johnson & Johnson, and Eli Lilly anchor the fund, balancing earnings resilience with demographic tailwinds.

Healthcare’s importance now lies in its predictability. In an environment of shifting rates and mixed consumer demand, this sector continues to generate steady cash flows and defend market cycles. XLV’s strength often signals where investors retreat when volatility returns — toward necessity, not novelty.

In a diversified portfolio, XLV plays the role of steady equilibrium against higher-beta exposure elsewhere.

Final Take

From chips to clean energy, performance is rotating toward innovation and resilience.

Semiconductors and AI power growth and efficiency; gold miners hedge uncertainty; renewables reflect the structural shift in global investment; healthcare provides the foundation.

Each ETF highlights a market adapting to new realities — where risk and stability can coexist when positioned with purpose.

Understanding why these ETFs matter now means seeing the market as it truly is: interconnected, evolving, and full of quiet signals hiding in plain sight.

For deeper weekly insights like this, subscribe to the Prosperiax newsletter below — it’s free