Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to find the coverage you actually need.

For decades, data centers have been treated as a terrestrial problem: build more warehouses, acquire more land, consume more electricity, draw more water, and find creative ways to cool the servers that run the digital economy. That model worked when compute demand grew linearly. It breaks when AI pushes demand into exponential territory.

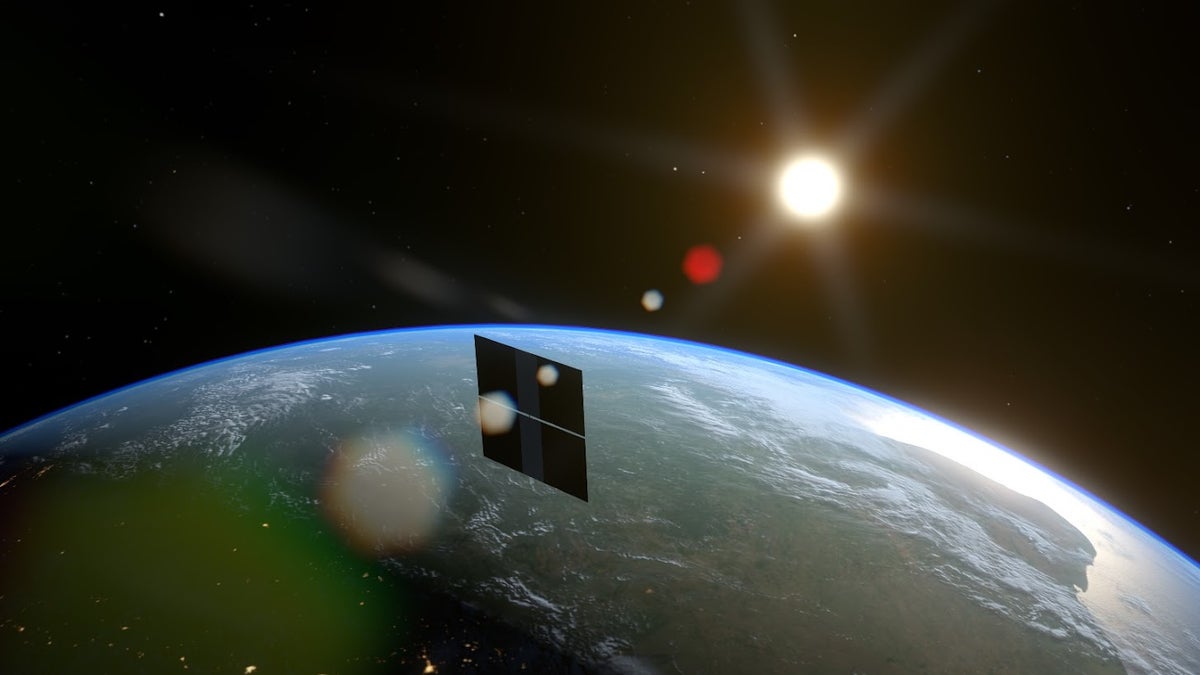

This is why a new idea — once science fiction — is gathering real attention: data centers in space.

The premise is simple but ambitious. If the world is running out of affordable energy, cooling capacity, and physical space to house the next generation of AI compute, the logical alternative is to move the infrastructure somewhere with unlimited solar energy, no weather, no land constraints, and near-perfect thermal conditions.

Orbit offers all of that.

And the market is starting to price in the possibility that the next great data-infrastructure boom may not happen on Earth.

What matters now isn’t the novelty.

It’s the question: Who’s actually positioned to win if this becomes real?

Why Space-Based Compute Is Suddenly a Serious Idea

Data centers already consume more energy than some industrial nations. AI accelerates that consumption dramatically. The economics of keeping data centers on Earth are deteriorating: energy costs, land constraints, and cooling limitations create bottlenecks that traditional scaling cannot solve.

Space, on the other hand, offers:

Continuous solar power with no night cycles.

Minimal cooling requirements due to the thermal environment of orbit.

Zero land usage, eliminating real estate constraints.

The ability to expand compute capacity horizontally by adding orbital clusters.

This is not a short-term fix. It’s a structural response to an unsustainable trajectory. And once one major player proves viability, capital will follow quickly — exactly the way it did with reusable rockets and satellite broadband.

The Investment Angle: Who Has the Advantage?

Every transformative technology eventually breaks into two categories:

Companies that can build it.

Companies that can monetize it.

Space-based data centers require both.

1. SpaceX — The Launch + Connectivity Monopoly

If this becomes real, SpaceX sits at the center of the economic stack.

No one launches mass to orbit at comparable cost or reliability. No one has the satellite network density of Starlink. And no one, outside NASA, has the infrastructure to deploy, service, and scale orbital compute clusters at global scale.

When SpaceX goes public in 2026, their valuation won’t be based on rockets alone. It’ll be based on the idea that they could control the backbone of space-based compute — the physical placement of hardware and the connectivity layer that ties it together.

If you believe in orbital data centers, SpaceX is not a bet on rockets.

It is a bet on owning the rails of a new digital economy.

2. Blue Origin — Bezos’s Long Game

Jeff Bezos has always approached space with a 50-year horizon. His interest in orbital data centers fits that worldview: infrastructure first, monetization second.

Blue Origin’s advantage isn’t speed — it’s strategy. Bezos understands cloud economics better than almost any CEO alive. He built AWS when most companies didn’t understand what cloud computing was. Space-based infrastructure is a logical extension of his original thesis: compute moves to wherever it is most efficient.

If solar-powered orbital data centers become viable, Blue Origin becomes the institutional anchor of the industry — long-term, methodical, foundational.

3. Rocket Lab — The Agile Challenger

Rocket Lab is not a mega-cap contender like SpaceX or a capital-heavy empire like Blue Origin. But it has an important position: it is the specialized, nimble launch partner for smaller, modular data-center satellites.

If orbital compute takes the shape of distributed clusters — rather than a few giant stations — Rocket Lab becomes essential infrastructure. Their smaller, more frequent launches are well-suited to the kind of iterative hardware deployment that space-based compute may require.

A niche today could become a structural position tomorrow.

4. Google — The Compute Buyer and Beneficiary

Google isn’t going to build rockets. It doesn’t need to. What Google has is:

The largest AI compute demand on Earth

The most advanced AI chip development outside of Nvidia

A corporate incentive to solve the energy and cost constraints of training frontier models

Google benefits not by controlling the hardware in space, but by offloading its compute pain into orbit. This makes Google both a critical partner and a potential early adopter — and where large enterprises adopt, markets follow.

5. The Startups — Aetherflux, Starcloud, and Orbital Compute Natives

Every major infrastructure shift begins with a company most people initially overlook. These startups aren’t trying to compete with SpaceX or Amazon; they’re building the actual compute modules, the AI racks, the cooling systems, and the orbital deployment architecture.

They won’t own distribution.

They won’t own the customer.

But they may create the standards everyone else follows.

In the long arc of technology, this is often where outsized returns emerge.

The Risk Factors Investors Can’t Ignore

A bullish thesis is incomplete without the friction:

Launch costs remain high — even with reusable rockets.

Thermal and radiation management for high-density compute is unsolved.

Latency constraints limit certain applications unless hardware is positioned at lower orbits.

Regulatory complexity increases drastically once compute becomes orbital infrastructure.

Insurance markets for orbital assets are still immature.

This isn’t a 2025–2027 story.

It’s a 2030–2045 story — but the market will begin pricing it long before implementation.

AI demand has already broken the economics of terrestrial data centers.

Space-based compute is not a science project. It is a pressure-release valve.

The moment AI pushed global compute demand past the limits of Earth-based infrastructure, the idea of orbital data centers stopped being science fiction and became financial inevitability.

Some companies will treat it as a branding exercise.

A few will build the underlying economics.

Only one or two will control the rails.

The winners will be the players that combine:

launch capability,

satellite networks,

capital scale,

compute demand,

and long-term infrastructure vision.

Right now, that short list includes SpaceX, Blue Origin, Google, and one or two specialized challengers.

This isn’t a bet on space.

It’s a bet on the future of compute.

And the companies positioning themselves today will be the ones shaping the architecture of the next technological era — not on Earth, but above it.

—

Education, not investment advice.

Sources: