Robinhood is often discussed in absolutes. To its critics, it is an unserious platform that collapses under real trading demands. To its supporters, it is one of the most consequential financial products of the past decade, responsible for broadening market access at an unprecedented scale. Both views contain truth, yet neither fully explains the friction experienced by traders who grow beyond the platform’s original design envelope. This paper argues that Robinhood’s most visible limitations are not operational failures but the logical outcome of deliberate design tradeoffs. By optimizing for simplicity, accessibility, and risk containment, the platform imposes structural ceilings that only reveal themselves as users scale capital, strategy complexity, and execution sensitivity. The result is a widening gap between user expectations and platform function—one that deserves analysis rather than dismissal.

I. A Trader Runs Into the Ceiling

Robinhood’s value proposition is straightforward: intuitive design, low explicit costs, and frictionless access to markets. For millions of users, this proposition works remarkably well. Problems emerge not at entry, but at progression, when a trader’s activity begins to stress the platform’s assumptions about scale, behavior, and risk.

The catalyst for this report was a public thread from an experienced options trader outlining a decision to withdraw capital from robinhood after years of use. The complaints were not emotional or ideological. They were precise. Cash held for collateral failed to earn interest. Execution quality lagged other brokers on identical trades. Options strategies encountered hard limits that could not be waived. Tick-size constraints and fill slippage compounded over time. None of these issues were catastrophic in isolation. Together, they changed the economics of trading at scale.

This is not an edge case. It is a pattern. And it raises a deeper question: what happens when a platform built to democratize finance becomes the limiting factor for the users it successfully graduates?

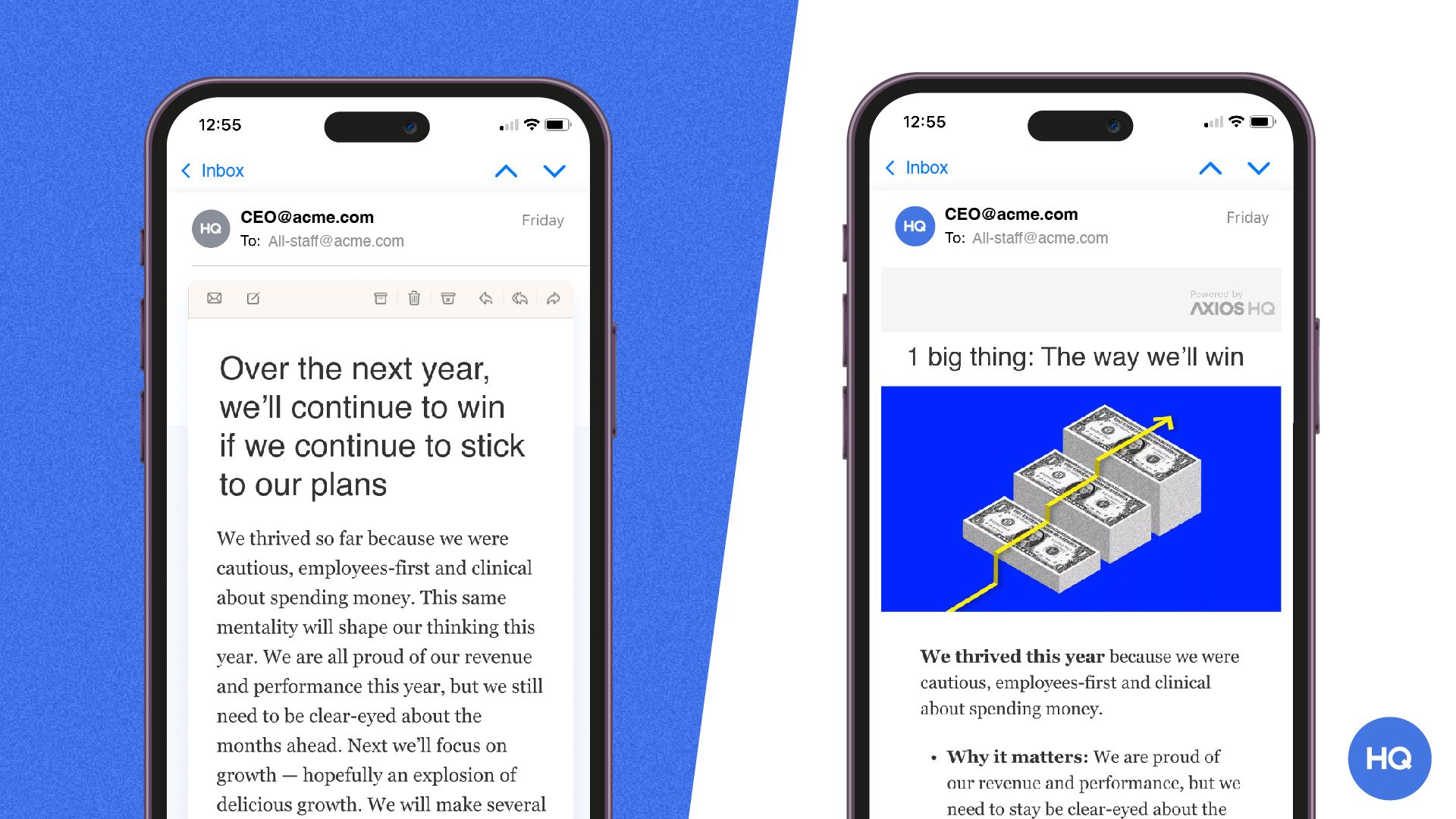

Attention is scarce. Learn how to earn it.

Every leader faces the same challenge: getting people to actually absorb what you're saying - in a world of overflowing inboxes, half-read Slacks, and meetings about meetings.

Smart Brevity is the methodology Axios HQ built to solve this. It's a system for communicating with clarity, respect, and precision — whether you're writing to your board, your team, or your entire organization.

Join our free 60-minute Open House to learn how it works and see it in action.

Runs monthly - grab a spot that works for you.

II. What Robinhood Is Optimized For

To understand the friction, it is necessary to understand what robinhood is—and is not—designed to do. The platform was built around three primary objectives: accessibility, simplicity, and risk containment. Each of these choices has consequences.

Accessibility favors a clean interface, limited product sprawl, and low cognitive load. Simplicity reduces operational complexity and minimizes user error. Risk containment protects the firm, the clearing system, and less experienced users from cascading losses. These are not arbitrary preferences. They are survival mechanisms for a platform operating at retail scale under regulatory scrutiny.

Viewed through this lens, many of robinhood’s constraints are intentional. Position limits reduce tail risk. Conservative margin treatment simplifies capital requirements. Limited order types reduce operational failure points. The absence of a traditional derivatives desk minimizes discretionary risk-taking by staff and customers alike.

The platform works as designed—for the use case it targets.

III. Where Friction Emerges at Scale

The problem arises when traders evolve faster than the platform’s design envelope. As position sizes grow and strategies become more complex, the tradeoffs that once felt protective begin to feel restrictive.

Execution quality becomes visible. Small price improvements that are irrelevant on single contracts compound meaningfully on size. Tick-size limitations shift economics subtly but persistently in favor of market makers. Cash sweep mechanics that are inconsequential on small balances become material opportunity costs when capital sits idle or tied up in collateral. Options contract limits, originally intended as guardrails, turn into hard ceilings that block otherwise sound strategies.

Importantly, these are not bugs. They are the shadow side of scale.

Other brokers solve these problems differently. They charge explicit fees. They offer human desks. They accept greater operational and balance-sheet complexity. Robinhood does not. The result is a platform that remains highly efficient for its core audience while becoming increasingly misaligned with advanced use cases.

IV. The Platform Did Not Break — the Use Case Changed

What makes the original critique compelling is not its severity, but its evolution. Shortly after the initial post, the same trader acknowledged robinhood’s mission, responsiveness, and genuine effort to improve execution transparency and product access. The frustration was not with intent. It was with fit.

This nuance matters. It reframes the issue from failure to mismatch. A platform can be well-built, mission-driven, and continuously improving—and still not be the right endpoint for every trader.

Robinhood did not abandon its users. Some users simply outgrew the environment it was designed to provide.

V. What This Means for Traders as They Grow

The lesson here is not prescriptive, It is diagnostic. Platforms encode assumptions about behavior, scale, and risk tolerance. When traders exceed those assumptions, friction is inevitable.

Low explicit fees do not guarantee low total cost. Execution quality, capital efficiency, and flexibility increasingly dominate outcomes as scale increases. What feels like convenience at small size can become constraint at larger size.

This does not diminish robinhood’s achievement. It contextualizes it.

For many traders, the platform remains more than sufficient. For others, especially those deploying complex options strategies or managing significant idle capital, the tradeoffs become too large to ignore.

The mistake is not using robinhood. The mistake is assuming that accessibility and scalability are the same problem.

VI. Synthesis

Robinhood is neither broken nor obsolete. It is highly effective within the boundaries it set for itself. The frustration voiced by experienced traders is not evidence of failure, but of graduation.

Design tradeoffs are unavoidable. Platforms that optimize for inclusion must limit complexity somewhere. Platforms that scale complexity must charge for it somewhere. Robinhood chose its side of that equation deliberately.

Understanding this distinction matters. It allows traders to make better decisions as they evolve. It allows observers to evaluate the platform honestly. And it allows the conversation to move beyond absolutes.

Robinhood can be a transformative product and still have a ceiling. Recognizing where that ceiling sits is not criticism. It is clarity.

—

Education, not investment advice.

Sources:

:max_bytes(150000):strip_icc()/CharlesSchwabvs.Fidelity-5c61bb5f46e0fb00017dd690.png)